Pro tip: How to avoid paying resort fees

Posted by admin on

In a world where there’s vast division on many topics, there’s still at least one universal truth: Resort fees stink.

Resort fees have been around for decades and, unlike airline change fees, resort fees seem to have made it through the pandemic as strong as ever.

But they weren’t always a traveler’s nemesis. As told by the site Kill Resort Fees, resort fees had humble beginnings, were much lower ($5–$10), were often optional, reserved only for those who wanted to use the resort’s amenities beyond the base room and rate. But today, resort fees can cost more than $100 per night, might be higher than the room rate itself and are seldom optional. For example, the nightly resort fee at Dorado Beach, a Ritz-Carlton Reserve property, is $125 – which is more than many hotel rooms.

For the latest travel news, deals and points and miles tips, subscribe to TPG’s daily email newsletter.

Out in Las Vegas, it’s common to find inexpensive rooms for as little as $30 per night at places like Rio, Bally’s and Excalibur, but the nightly resort fee is likely to cost more than the room on those inexpensive nights, more than doubling your actual price paid.

In the last few years, online booking sites and even an attorney general have tried fighting back against resort fees in various ways (up to and including a new suit filed against Marriott). While battles are being waged against these now commonplace, mandatory fees — known by many names — here in 2021, travelers are far still from winning the war on resort fees.

But, that doesn’t mean you have to spend $30, $50 or potentially more than $100 per night of your own hard-earned cash on these resort fees, destination fees, facility fees or whatever they are called next.

While resort fees are proving to be a formidable foe, you can personally avoid resort fees with some strategy and careful booking.

In This Post

How to spot resort fees

To beat a resort fee, you have to know how to spot one — and that can be tough, especially now that even non-resorts tack on “destination fees” that often provide little to no value. While many brands are decent at prominently disclosing resort fees when pricing out rooms online, others can be sneakier.

For example, some resorts, such as Great Wolf Lodge, don’t display the resort fee until the last booking step. That’s actually an improvement over a few years ago when it wasn’t broken out at all but just lumped with taxes and fees, but it’s easy not to see it coming at you if you don’t know to expect it at the end of the booking process.

Also, know that while most properties that charge resort (or destination) fees charge a flat fee per night, per room, others charge a percentage of the room rate or a per person resort fee. Never assume you know the real cost until you dig deeper and price the entire stay with the correct number of room occupants.

Related: Make sure you’re getting the most out of your Marriott resort fees

Ways to Avoid Resort Fees

Book an award stay

One of the easiest methods to avoid a resort fee is to book a room using hotel points.

Multiple hotel loyalty programs waive resort fees on award stays made purely with points (as opposed to cash and points that may have added fees). As an example, per program rules, Hilton and Hyatt consistently waive resort fees on award stays.

Wyndham Rewards is also known for waiving resort fees on award stays, though I’ve heard more issues with spotty implementation with that program than the first two. Choice also has been known to waive resort fees on some award stays.

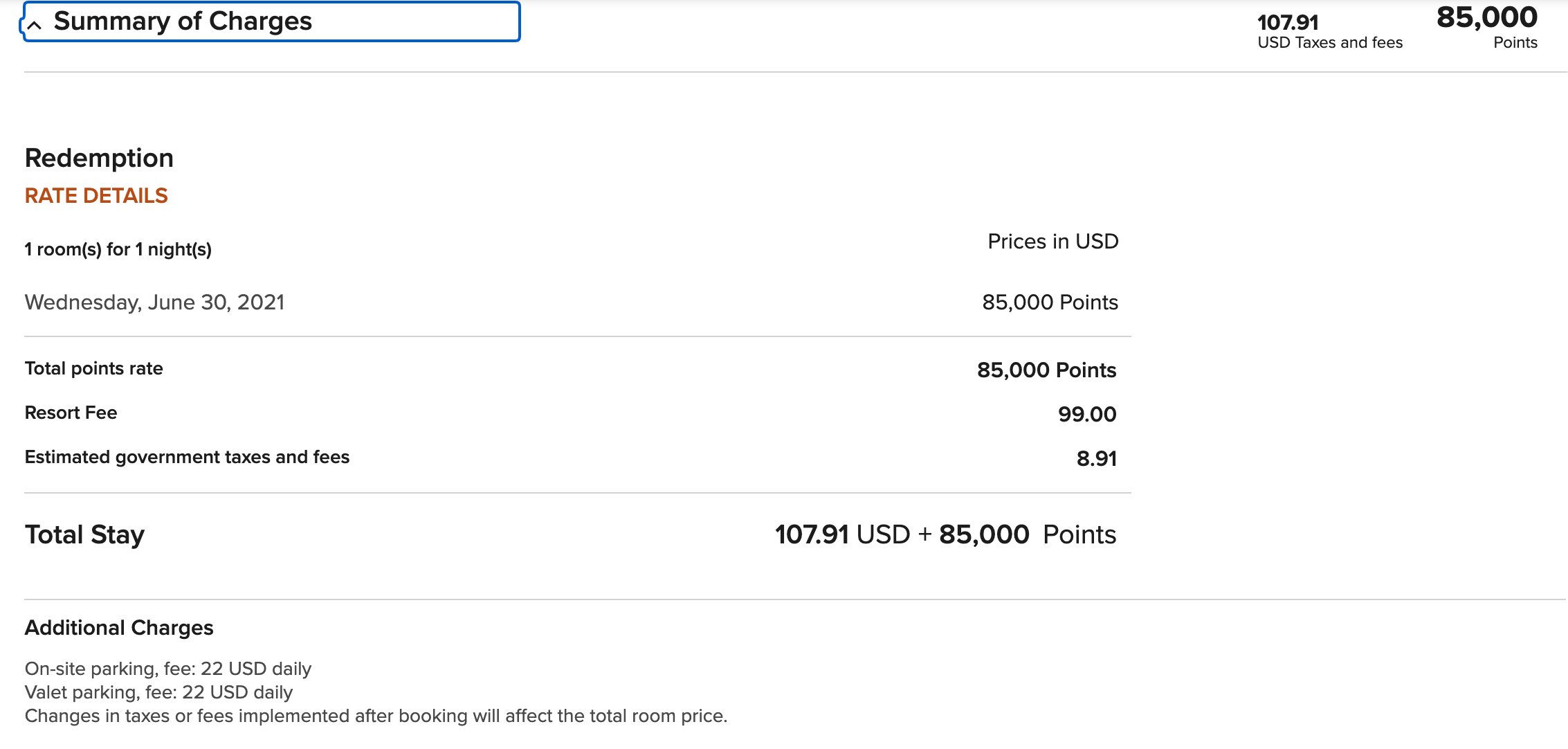

Marriott, notably, does not waive resort fees on award stays. And in fact, that can cost you over $100 at some resort properties per night, even when you use points.

My advice, focus on Hilton and Hyatt for the most reliable resort-fee-free award stays.

You can earn Hilton points with a plethora of cobranded credit cards:

- Hilton Honors American Express Card: Earn up to 130,000 bonus points. That’s awarded as 80,000 points after you spend $1,000 in purchases on the Hilton Honors American Express Card in the first 3 months and an additional 50,000 points after spending a total of $5,000 in purchases on the card in the first six months. ($0 annual fee; see rates & fees)

- Hilton Honors American Express Aspire Card: Earn 150,000 Hilton points after spending $4,000 in the first three months. ($450 annual fee; see rates & fees)

- Hilton Honors American Express Surpass® Card: Earn up to 180,000 bonus points awarded as 130,000 bonus points after spending $2,000 within the first three months of card membership and an additional 50,000 points after spending a total of $10,000 in purchases on the card in the first six months. ($95 annual fee; see rates & fees)

The information for the Hilton Aspire Amex Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

You’ve got even more options when you need World Of Hyatt points since they transfer on a 1:1 basis from Chase Ultimate Rewards. So, if you have the Chase Sapphire Reserve or Chase Sapphire Preferred Card, you can easily transfer those points to your Hyatt account. Right now, the Sapphire Preferred is offering an all-time high bonus of 100,000 points after you spend $4,000 on the card in the first three months of account opening.

You can also pick up the World of Hyatt Credit Card. Earn 30,000 bonus points after spending $3,000 on purchases within the first three months from account opening. Plus, up to 30,000 more bonus points by earning 2 bonus points total on purchases that normally earn 1 bonus point, on up to $15,000 in the first six months of account opening. The annual fee is $95.

Related: My new ‘trick’ for avoiding pesky resort and destination fees on last-minute stays

Use your elite status

Whether you’re on a paid stay or an award stay where you’re asked to pay a resort fee, having elite status can potentially help. For example, within the World Of Hyatt program, those with Hyatt Globalist status do not pay resort fees, even on paid stays.

The application of this isn’t as smooth as with waived resort fees on award stays, but the rules are clear that top-tier Hyatt elites shouldn’t be charged resort fees when on eligible paid rates. Note that having the World of Hyatt Credit Card helps you earn Hyatt Globalist status faster with spending on the card, which was part of how I re-earned it this year and immediately started saving money on fees as a result. For example, my stay at the Andaz Mayakoba in a pricey suite would have cost a lot more if I had to pay a percentage of the stay as a resort fee, which would happen without Globalist status.

In Las Vegas, resort fees are rampant, but Diamond or Seven Stars members within the Caesars Rewards program don’t pay resort (or parking) fees at casinos such as Caesars Palace, Planet Hollywood, Harrah’s, Bally’s, etc.

This can help you out even if you’re never going to earn your status through gambling, as there are plenty of ways to get status in the Caesars Total Rewards program without gambling and go from Vegas zero to hero in a flash. For example, the Wyndham credit card provides status that matches to Caesars Diamond status. Or, you can match status from another casino program, such as M life to Caesars. And your M life status can be earned by matching your Hyatt status.

If that all sounds like status dominos, it totally is. But it can save you lots of money if you frequent Vegas by avoiding resort fees with your Caesars status.

Look for a hotel without resort fees

Some travelers simply refuse to ever pay resort fees and will immediately cross off any property that charges them from their lists. In places like Las Vegas, Hawaii, Orlando and similar, there’s no long list of hotels without resort fees, but there are often a few if you look hard enough.

Here’s a link to Las Vegas hotels without resort fees, but fair warning, the options aren’t that great. Here’s a similar list for Hawaii (be sure to double-check that nothing has changed since the list was last updated.)

If you can’t find a hotel you want without a resort fee, you can consider Airbnb or other home rental services. However, note that even Airbnb hosts can charge a resort fee if they manage six or more listings, so book carefully there, too. There are also other fees charged by some vacation home renters that can add up to more than resort fees, so just read all the fine print.

When in doubt, consult the website ResortFeeChecker.com to verify if a given property is known for charging a resort fee or not.

You can ask not to pay the resort fee

One strategy that is far from guaranteed, but works some percentage of the time, is to simply ask not to pay the resort fee — especially if you are not going to use the included amenities. This is true now more than ever, as the full list of resort amenities hasn’t returned everywhere.

But this “ask nicely” strategy obviously doesn’t always work — even when some elements that should be included in a resort fee are closed, missing or broken.

For example, during a recent stay in Las Vegas a couple of years ago, a TPG staffer attempted to avoid at least some of the $37 per night resort fee when the safe he needed to use for his passport was broken. The safe was listed as a resort fee amenity and the Wi-Fi didn’t always work on the stay. The answer was … no dice.

He had to pay the full fee even though the key listed elements didn’t actually work.

However, at a resort in Hawaii, a different TPG staffer was able to get a resort fee waived when the pool was closed during the stay. In other words, it never hurts to ask for resort fees to be waived, but don’t just assume you’ll be able to talk or protest your way out of them. The best plan is to avoid the fees in the first place.

Related: The zero-cost vacation: 100+ all-inclusive resorts you can book with points

Bottom line

Resort fees have been a growing problem in the travel industry for a long time. And while some airline change fees were eliminated in the pandemic, the same is not generally true of resort fees.

These fees are expensive, annoying, sometimes poorly disclosed and often don’t actually add any real value to the stay. But unfortunately, for now, they seem to be going anywhere anytime soon, so it’s best to take matters into your own hands and learn how to avoid them.

Featured image of The Confidante Miami courtesy of Hyatt

For rates and fees of the Hilton Amex card, click here.

For rates and fees of the Hilton Aspire card, click here.

For rates and fees of the Hilton Surpass card, click here.