The Top 8 Decentralized Lending Platforms

Posted by admin on

DeFi, short for decentralized finance, describes the financial services and products available to cryptocurrency holders.

DeFi has a wealth of unconventional features that make it appealing to the crypto community, such as accessing financial services without requiring personal identification. DeFi also differs from conventional banking in how it works— no central entity controls the assets users deposit on their platform. Instead, DeFi relies on programmable smart contracts to provide financial services.

Read on to discover the best DeFi platforms we have compiled that will allow you to access financial services with your crypto assets.

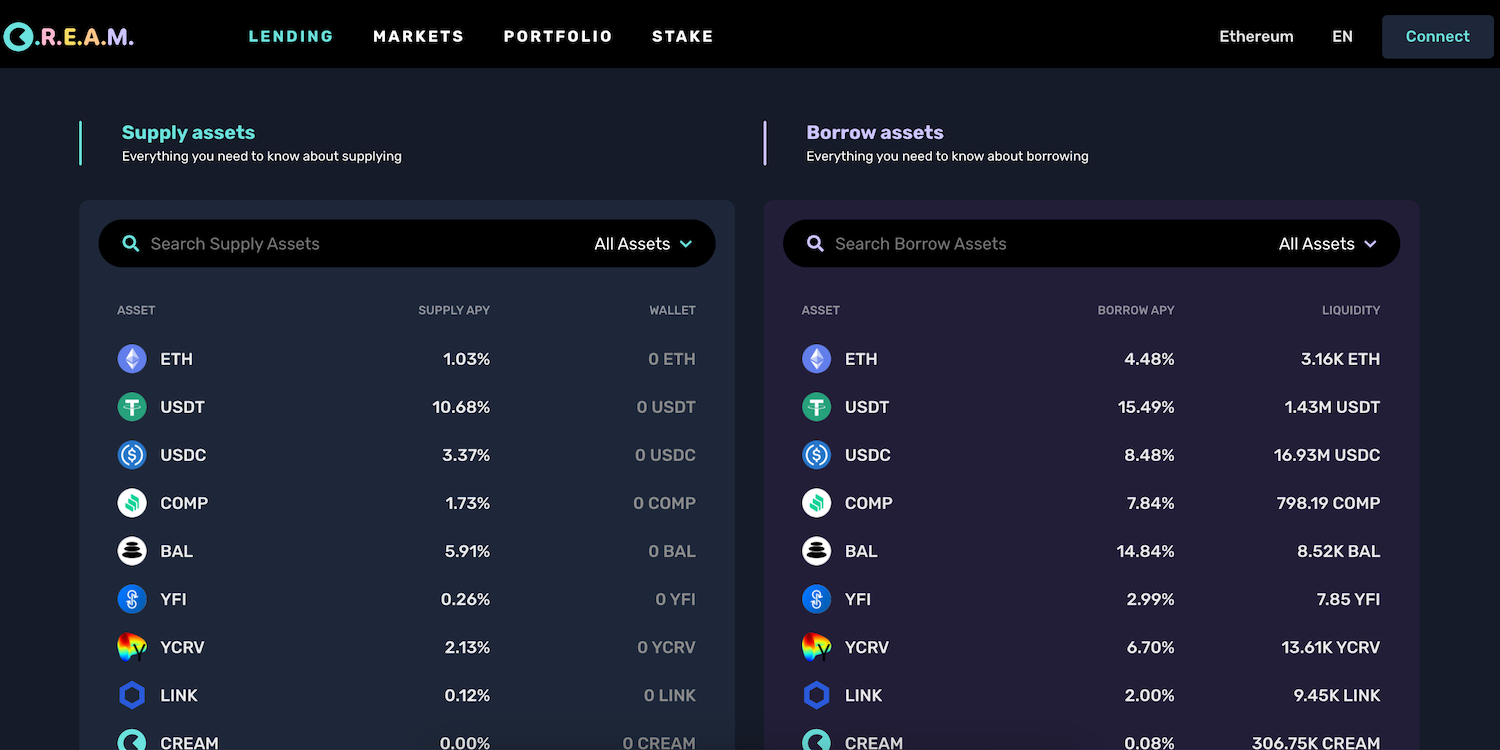

1. C.R.E.A.M. Finance

C.R.E.A.M. Finance, short for Crypto Rules Everything Around Me, is an open-source DeFi platform that allows cryptocurrency holders to access financial services. C.R.E.A.M. is blockchain agnostic and runs on Ethereum, Fantom, and Binance Smart Chain.

Users can lend and borrow up to 40 supported cryptocurrencies on C.R.E.A.M. and earn interest similar to a traditional bank account. C.R.E.A.M. is permissionless, so no identity or credit card checks are required for all lending and borrowing.

Related: The Pros and Cons of Cryptocurrency Transactions

After you lend or deposit your crypto assets on C.R.E.A.M., you will receive a crToken, representing your asset that will earn interest. The interest rate you earn on deposited assets depends on the supply and demand for that particular asset.

C.R.E.A.M. also has its own governance token CREAM on the Ethereum blockchain. Users receive CREAM tokens when they interact with C.R.E.A.M. Finance through lending and borrowing. CREAM token holders have special rights and can vote to influence the platform's direction, such as which new cryptocurrencies should be added to the platform.

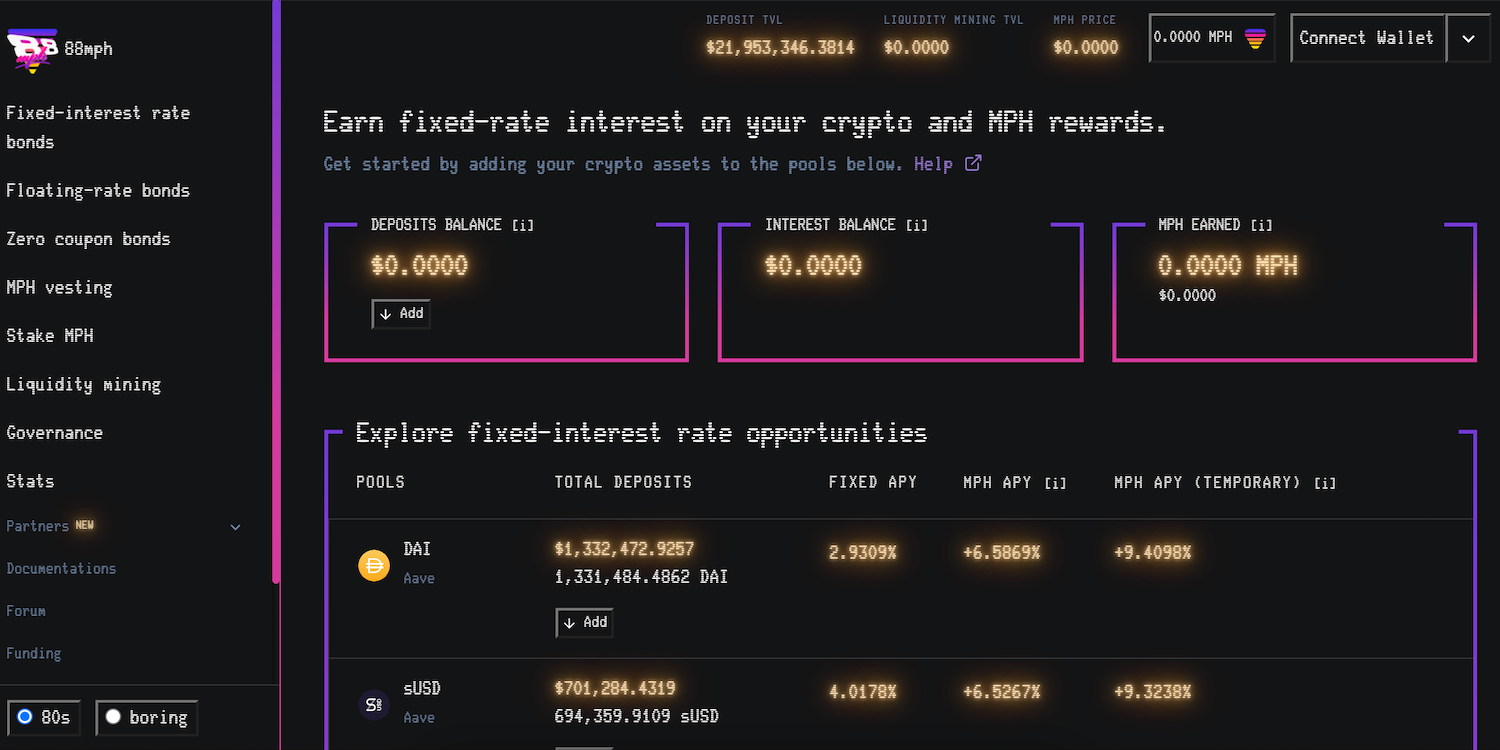

2. 88mph

88mph is a DeFi platform that allows users to deposit cryptocurrency assets and earn interest at a fixed rate. 88mph differentiates itself from other DeFi platforms by offering users the option to purchase floating-rate bonds.

88mph accepts deposits in several stablecoins and tokens. A deposit is added to a pool of deposits, and users receive a non-fungible token representing their initial deposit. After the lending period is over, users can withdraw their initial deposit and the fixed-rate interest earned.

Related: What Is a Cryptocurrency Stablecoin?

Users can also earn MPH tokens by interacting with 88mph, such as depositing cryptocurrency assets or purchasing floating-rate bonds. In addition, MPH holders have voting rights and have the opportunity to influence the direction 88mph takes.

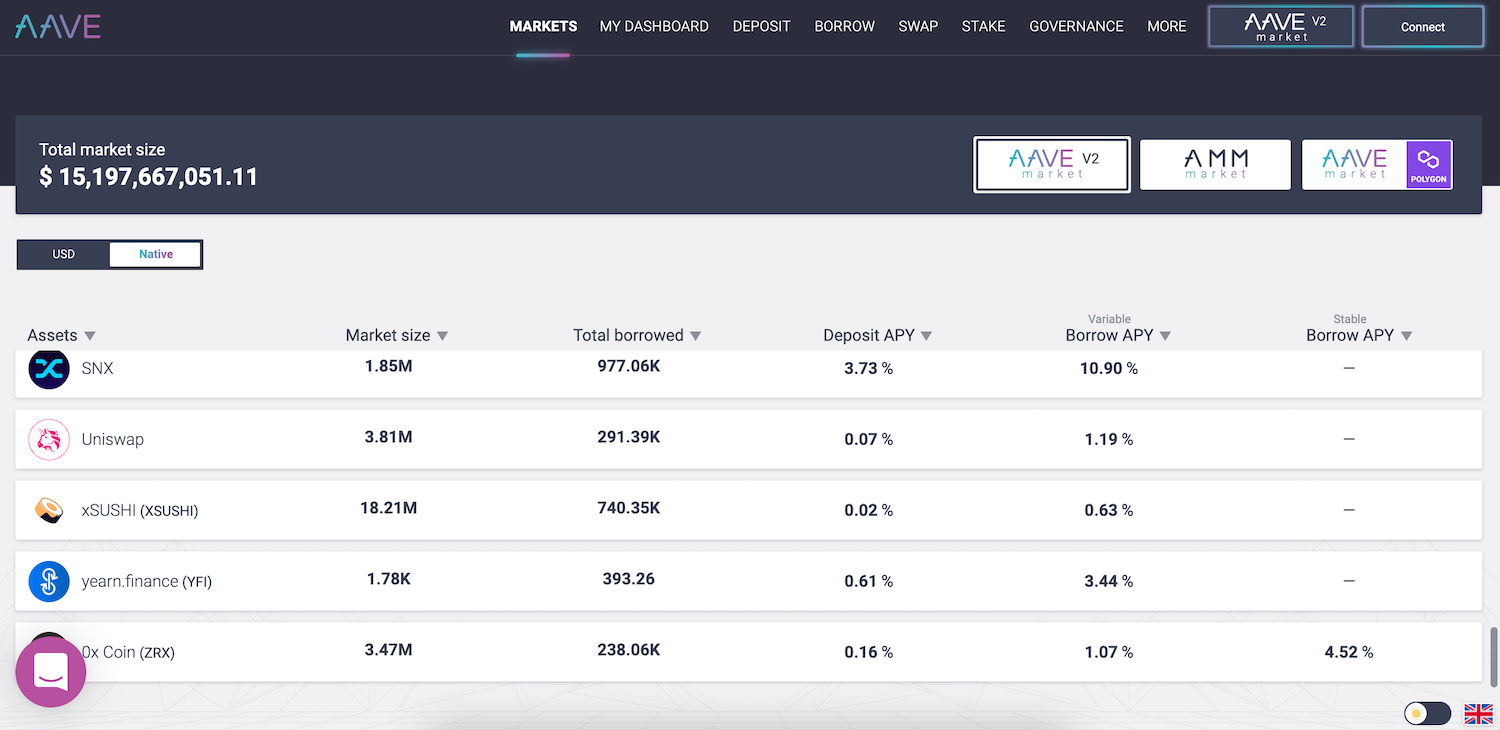

3. Aave

Aave is an open-source DeFi platform where users can deposit and borrow assets across more than 20 supported cryptocurrencies.

Depositors can earn a passive income based on the market demand of the cryptocurrency they deposit on Aave. Depositors can also use their deposited funds as collateral to borrow other assets with a fixed or variable interest rate.

Aave's most innovative service is its flash loans, a unique concept in the DeFi space. Flash loans allow users to borrow assets without providing collateral. Aave's other unique feature allows users to swap their deposited assets or collateral with another supported asset at any time.

Aave has its own governance token, AAVE. AAVE holders have voting rights and can contribute to Aave's direction by voting on Aave's Improvement Proposals.

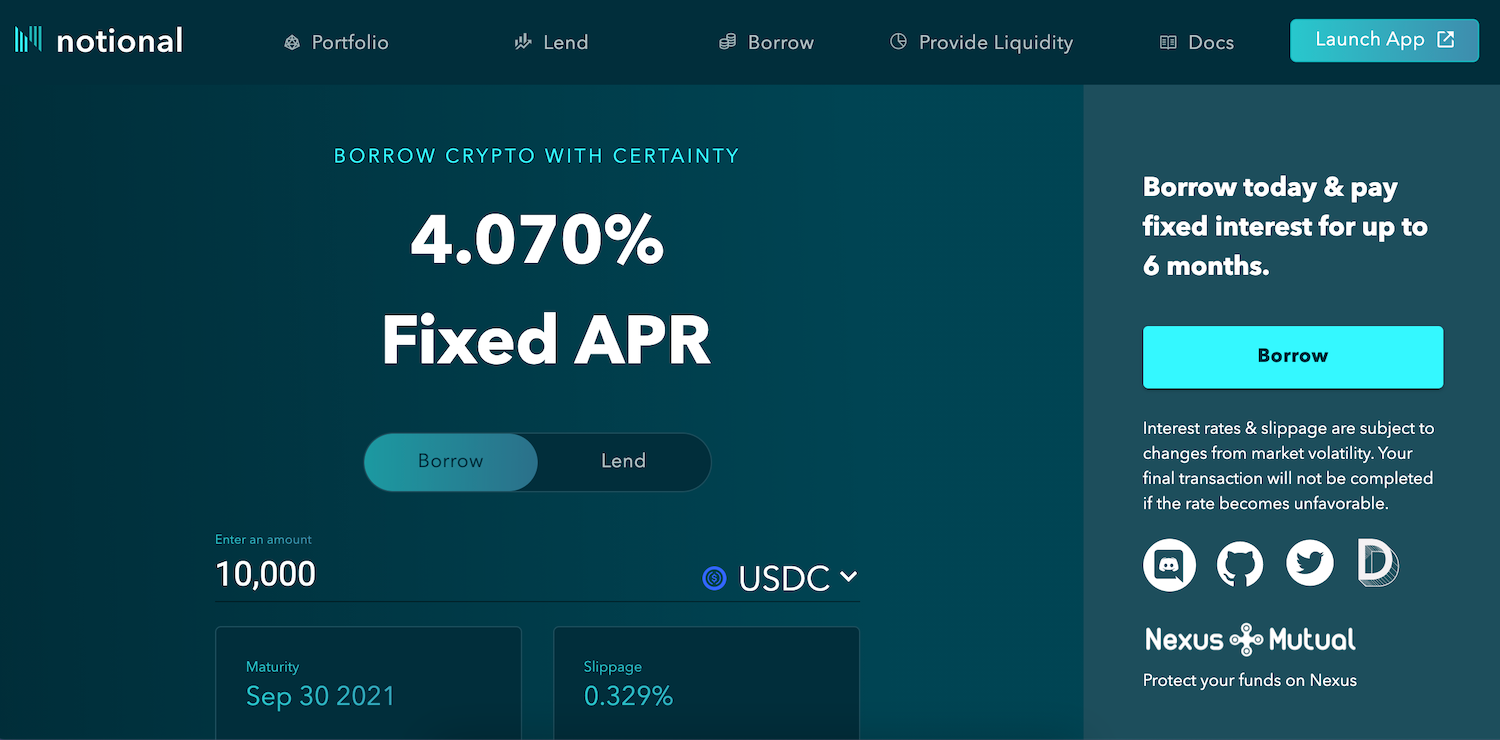

4. Notional

Notional allows cryptocurrency holders to lend and borrow their assets at a fixed term for a fixed interest rate. Notional's system is powered by their fCash tokens.

Cryptocurrency holders can lend their assets at a fixed interest rate to Notional's liquidity pool by purchasing an fCash token, which will be redeemed for cryptocurrency at a fixed date in the future.

Likewise, users who want to borrow at a fixed interest rate can sell an fCash token for cryptocurrency after depositing collateral. Borrowers must repay their fixed amount of debt at a specific date in the future.

Cryptocurrency holders can also act as liquidity providers by depositing their assets in Notional's liquidity pools. Liquidity providers earn yield when lenders or borrowers trade their cryptocurrency and fCash tokens.

Related: What Are Smart Contracts?

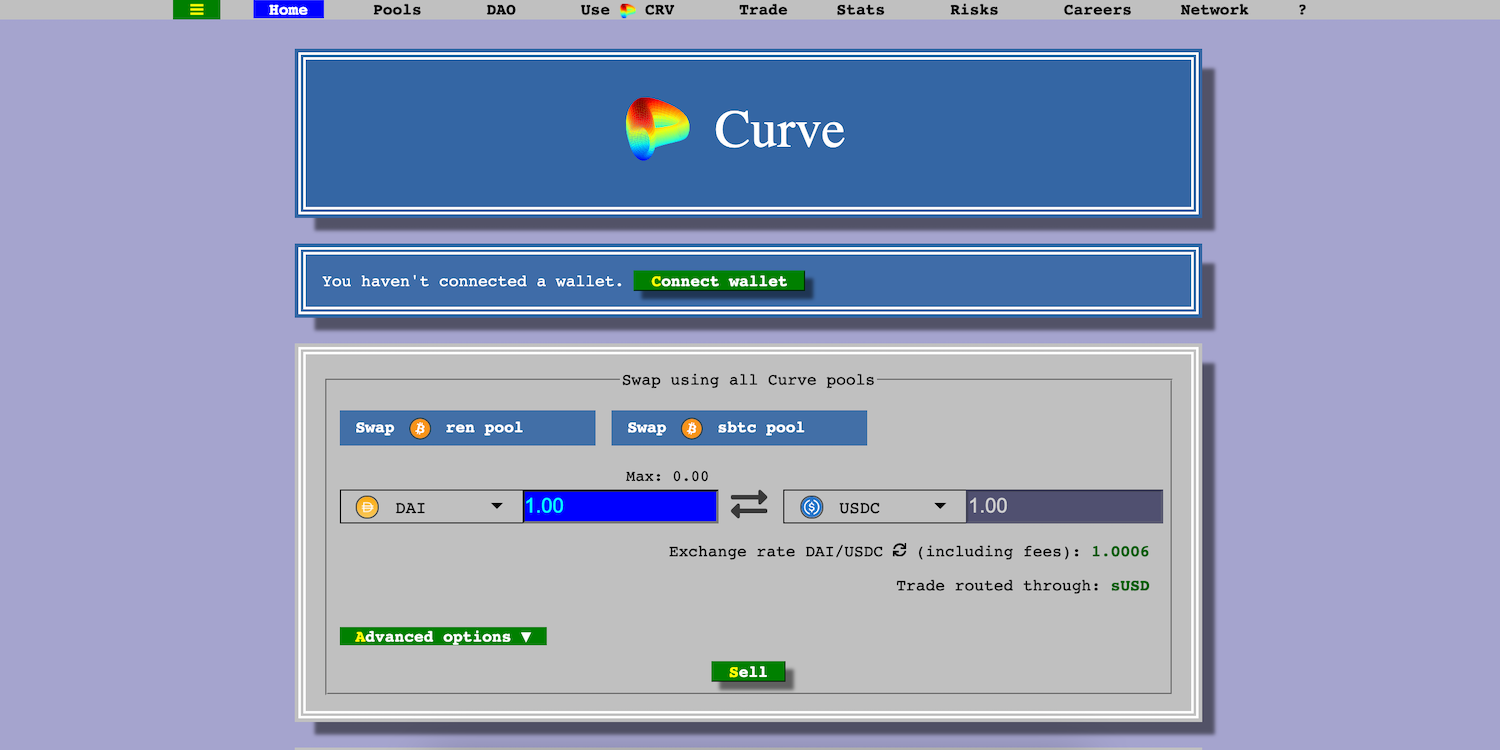

5. Curve

Curve offers decentralized exchange (DEX) services for stablecoin holders on the Ethereum network. Curve's most attractive features are its low fees and low slippage algorithm.

In addition to stablecoin trading, users can deposit their assets into Curve's liquidity pools to earn a passive income. Liquidity providers can deposit a range of different stablecoins as well as tokenized Bitcoins.

Curve also has its own governance token, CRV, which is awarded to liquidity providers on Curve. This means that as a liquidity provider, you have the opportunity to influence the platform's direction through voting.

6. Compound

Compound is an open-source DeFi platform that aims to emulate the traditional banking experience without constraints and inefficiencies. Interacting with Compound is easy. All you need to do is connect your crypto wallet.

Related: The Best Cryptocurrency Wallets: Desktop, Mobile, and Hardware Options Compared

Users have the opportunity to deposit their cryptocurrency assets on Compound with a variable interest rate more attractive than what a traditional bank would offer. As soon as a deposit is made, interest begins to accumulate. Users can withdraw their initial deposit and the interest accumulated at any time. Users can also borrow crypto assets from Compound by making a collateral deposit first.

Compound has its own governance token, COMP. COMP tokens are allocated to users who borrow or deposit assets into Compound, and holders can propose and vote to implement changes on the platform.

7. MakerDAO

MakerDAO is an open-source DeFi platform that allows users to obtain Maker's native stablecoin, Dai, in exchange for cryptocurrency collateral.

To obtain Dai, users must first deposit their cryptocurrency collateral into a Maker Vault. The amount of Dai the user receives depends on how much collateral they provide and the collateralization ratio for that particular cryptocurrency asset. Dai holders can also earn interest by depositing their tokens into a Dai Savings Rate contract.

MKR is Maker's governance token, which can be acquired through a cryptocurrency exchange such as Uniswap or by taking part in one of the protocol's auctions. MKR holders can influence the platform's direction by voting on proposed changes and submitting proposals to be put to the vote. MKR tokens also play a recapitalization role, which incentivizes holders to govern the protocol responsibly.

8. Uniswap

Uniswap is an open-source, decentralized exchange on the Ethereum network. Uniswap doesn't require identity checks to access their financial services, all you need is an Ethereum wallet, and you're good to go.

Related: What Is a Cryptocurrency Wallet?

In addition to providing DEX services for supported tokens, users can also earn income by depositing their assets into one of Uniswap's liquidity pools. Liquidity providers can redeem their funds at any time, in addition to the income earned.

Uniswap has its own governance token, UNI, allowing users to govern the protocol by voting on proposals.

Do Your Research First

Decentralized finance is one more exciting way the crypto world continues to evolve.

If you decide to use a DeFi platform, thoroughly research the platform you are considering. There are usually documents and whitepapers accompanying the websites of most DeFi platforms, which explain how the platform operates.

DeFi platforms will also typically send their smart contracts to security firms for multiple audits. Audits are intended to find vulnerabilities and bugs in smart contract code and boost user confidence in the DeFi platform.