Southwest Priority credit card review: Valuable perks plus a Companion Pass

Posted by admin on

Editor’s note: This is a recurring post, regularly updated with new information.

Southwest Rapid Rewards Priority Credit Card overview

The Southwest Rapid Rewards Priority Credit Card is the most rewarding of Southwest Airlines’ personal credit cards, offering a $75 annual Southwest credit and 7,500 anniversary bonus points. With a healthy sign-up bonus and the most benefits of any of the airline’s offerings, this is the card to get if you’re a Southwest loyalist. Card Rating*: ⭐⭐⭐½

*Card Rating is based on the opinion of TPG’s editors and is not influenced by the card issuer.

Southwest Airlines has a legion of fans — largely due to its flexible change/cancellation policies and offering two free checked bags for all passengers. Unlike other airlines, Southwest doesn’t offer lounges, premium cabins or even seating with extra legroom. But it does offer a full suite of cobranded credit cards to help frequent flyers fulfill their Southwest travel goals.

The Southwest Rapid Rewards Priority Credit Card is the most premium personal credit card in the Southwest lineup. It offers hundreds of dollars in value with Southwest each year, plus its current sign-up bonus offers points and a Companion Pass valid through February 2024.

But are its benefits valuable enough to warrant the $149 annual fee? And is now the right time for you to apply? Let’s find out.

Welcome offer: Companion pass plus 30,000 points

The Southwest Rapid Rewards Priority Credit Card currently offers a welcome bonus of a Companion Pass and 30,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. The Companion Pass is valid until Feb. 28, 2024 (excludes taxes and fees from $5.60 one way); however, the points don’t expire. TPG values Rapid Rewards points at 1.5 cents each, meaning 30,000 points are worth $450. This offer ends March 13.

The Southwest Companion Pass is a two-for-one benefit that allows you to bring a designated friend or family member along on any Southwest flight — including award flights booked with points. With the Companion Pass, you just pay the taxes and fees on the second ticket. If you regularly fly with another person, this one perk can be extremely lucrative.

To attain the Southwest Companion Pass, you typically need to earn 135,000 qualifying points (up from 125,000 points in previous years) or take 100 qualifying one-way flights in a calendar year. The Companion Pass earned this way is valid for the full year it’s earned plus the following year.

In contrast, the Companion Pass received through the current sign-up bonus is valid only through Feb. 28, 2024, regardless of the date you earn it from completing the spending requirements.

Related: 13 lessons from 13 years’ worth of Southwest Companion Passes

All Southwest cards are subject to Chase’s 5/24 rule. This means if you’ve opened more than five credit cards in the past 24 months (from all banks, not just Chase), you may not be approved. Also, you can’t open a new personal Southwest card if you currently have one open or if you earned a sign-up bonus in the past 24 months on any personal Southwest card.

Main benefits and perks

The Southwest Priority card offers the following benefits:

- Anniversary bonus: Each year on your card-opening anniversary, you’ll receive 7,500 Rapid Rewards points, worth about $112, based on TPG’s valuations.

- Annual Southwest travel credit: During each cardmember year, you’ll receive a $75 travel credit that can be used on most Southwest purchases, including tickets (but excluding upgraded boardings and inflight purchases), dropping the card’s actual cost to $74.

- Four upgraded boardings per year: Use your card to pay for A1-A15 boarding spots and you’ll be reimbursed up to four times per year. Ordinarily, upgraded boarding costs between $30 and $50 per round-trip upgrade, so this perk can be worth up to $200 per year. You can purchase upgraded boardings online, through the app or at the airport.

- 25% inflight savings: Receive 25% back (as a statement credit) after you use your card to purchase inflight drinks, Wi-Fi, messaging and movies.

- Tier qualifying points boost: Earn 1,500 TQPs that count toward A-List and A-List Preferred status for each $10,000 you spend in a calendar year.

In addition to the Southwest-specific benefits, the card comes with lost luggage reimbursement, baggage delay insurance, extended warranty coverage and purchase protection. The card has no foreign transaction fees, and the annual fee is $149.

Earning and redeeming

Here’s what you’ll earn with the Southwest Priority card:

- 3 points per dollar on Southwest purchases.

- 2 points per dollar spent with Rapid Rewards hotel and car rental partners.

- 2 points per dollar on local transit and commuting, including rideshare apps.

- 2 points per dollar on internet, cable, phone services and select streaming.

- 1 point per dollar on all other purchases.

Redeeming points with the Southwest Rapid Rewards Priority Credit Card is very straightforward. Southwest award prices are directly tied to the cash value of the ticket, meaning the number of points you need for a flight will fluctuate but you’ll rarely encounter times when you can’t use your points. Plus, if your plans change, you can redeposit your award without penalty.

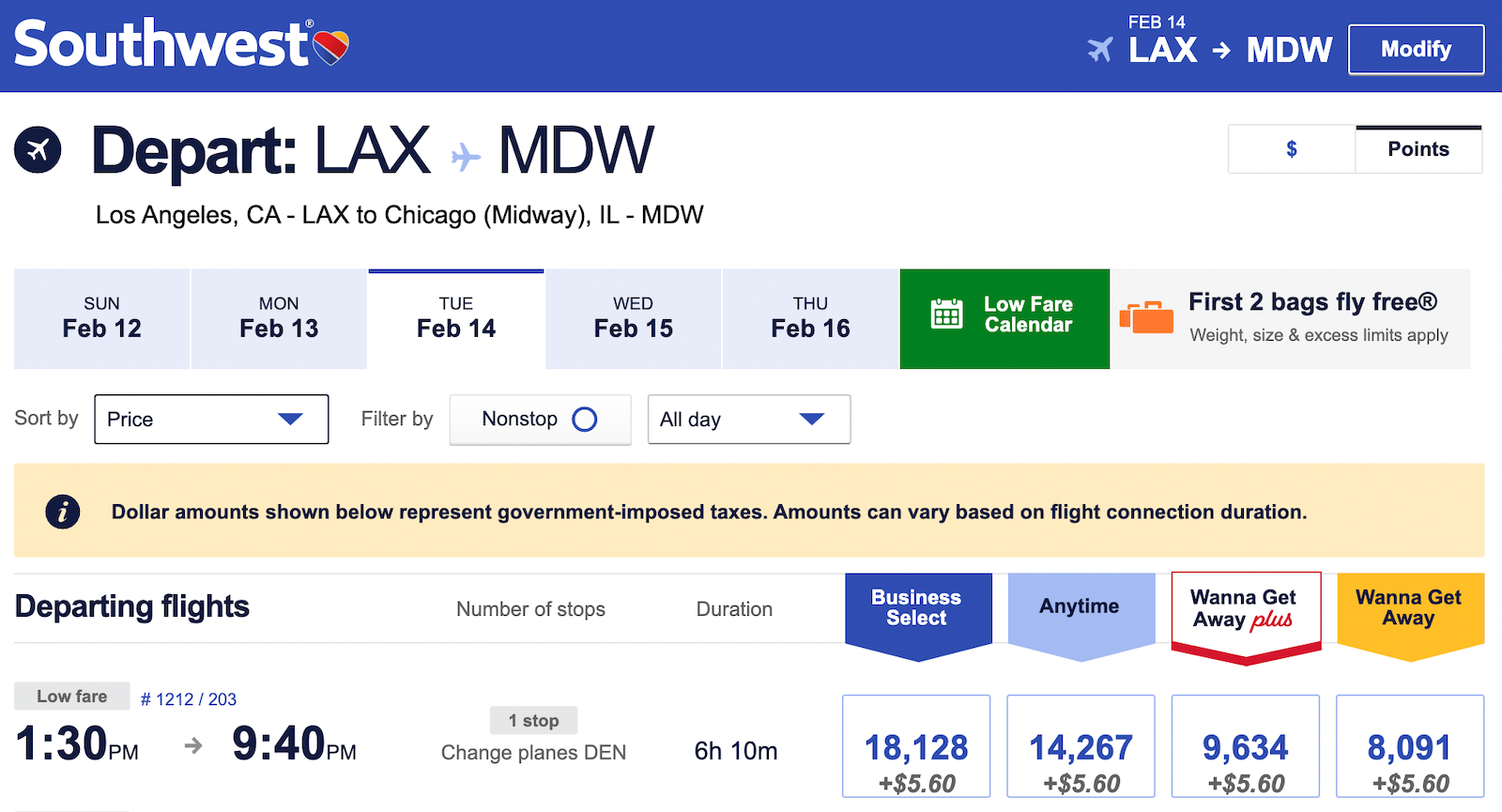

While Southwest’s Rapid Rewards points won’t help you fly in first-class suites, they can provide great value. For instance, you can fly from Los Angeles (LAX) to Chicago-Midway (MDW) for just 8,091 points one-way, depending on the time of year. Meanwhile, other airlines often charge 10,000 miles or even more (assuming you can find availability).

If you book during one of Southwest’s flash sales, you could score awards for less than 2,500 points one-way. You can even fly to fun faraway destinations like Hawaii, Costa Rica and Mexico with your Southwest points.

Comparing the Southwest Priority with other Southwest personal cards

Southwest Airlines currently offers three personal cards — all with the same sign-up bonus. Thus, it can be difficult to choose the right one. Here’s a comparison of these cards:

| Card feature | Southwest Rapid Rewards Plus Credit Card | Southwest Rapid Rewards Premier Credit Card | Southwest Rapid Rewards Priority Credit Card |

| Annual fee | $69. | $99. | $149. |

| Sign-up bonus |

30,000 points plus a Companion Pass(excludes taxes and fees from $5.60 one way) valid through Feb. 28, 2024 after you spend $4,000 on purchases in the first three months from account opening. | 30,000 points plus a Companion Pass(excludes taxes and fees from $5.60 one way) valid through Feb. 28, 2024 after you spend $4,000 on purchases in the first three months from account opening. | 30,000 points plus a Companion Pass(excludes taxes and fees from $5.60 one way) valid through Feb. 28, 2024 after you spend $4,000 on purchases in the first three months from account opening. |

| Anniversary points bonus | 3,000 Rapid Rewards points. | 6,000 Rapid Rewards points. | 7,500 Rapid Rewards points. |

| Earning rates |

|

|

|

| Other perks | 25% back on inflight drinks and Wi-Fi. | 25% back on inflight drinks and Wi-Fi. | 25% back on inflight drinks and Wi-Fi.

$75 annual Southwest travel credit. |

| Tier qualifying points | N/A. | Earn 1,500 TQPs for each $10,000 spent in a calendar year (with no limits). | Earn 1,500 TQPs for each $10,000 spent in a calendar year (with no limits). |

| Upgraded boardings (when available) | N/A. | N/A. | 4 per year. |

| Early Bird Check-In | 2 per year. | 2 per year. | N/A. |

| Foreign transaction fee | 3%. | None. | None. |

The Southwest Priority card is the obvious choice for regular Southwest flyers. The $75 travel credit effectively drops the card’s annual fee to $74.

Factor in its 7,500-point anniversary bonus — worth $112.50 according to TPG’s latest valuations — and you’ll actually come out $38.50 ahead just by having the card. This is before considering the card’s other perks.

However, the Southwest Priority card doesn’t just compete with other Southwest cards. It also can go head to head with more general travel cards — which may even offer a direct pathway to earning Rapid Rewards points.

Two cards that effectively earn Southwest points are the Chase Sapphire Preferred Card and Chase Sapphire Reserve. Southwest is a 1:1 transfer partner of Chase Ultimate Rewards, so you can easily transfer your points earned with either of these cards to the airline. The Sapphire Preferred has a $95 annual fee and earns:

- 5 points per dollar on travel booked through the Chase travel portal.

- 5 points per dollar on Lyft (through March 2025).

- 5 points per dollar on Peloton equipment and accessory purchases of $250 or more (through March 2025) — up to 25,000 points.

- 3 points per dollar on dining, select streaming services and online groceries (excludes Target, Walmart and wholesale clubs).

- 2 points per dollar on travel booked outside the Chase portal.

- 1 point per dollar on everything else.

It also offers valuable travel benefits, including primary car rental coverage and trip delay protection.

Related: Chase Sapphire Preferred card review

Meanwhile, the Sapphire Reserve offers 3 points per dollar on all travel and dining purchases (other than those covered by the $300 in annual travel credits) plus many of the same travel protections as the Sapphire Preferred. In addition, you’ll enjoy Priority Pass lounge access and earn points at higher rates on travel, Lyft rides and Peloton purchases. However, the card does come with a notably higher annual fee of $550.

Related: Chase Sapphire Reserve review

If you value the flexibility of a transferable points program like Chase Ultimate Rewards (but still want the choice to convert your earnings to Southwest points), then one of these cards may be your best bet.

Otherwise, if you’re after Southwest-specific perks when you travel, the Southwest Priority card could make a lot of sense.

Related: I tend to avoid these two Chase Ultimate Rewards transfer partners — here’s why

Bottom line

If you fly Southwest at least a few times each year, you’re sure to come out ahead with the Southwest Priority Credit Card. The card’s everyday earning rates leave something to be desired, but impressive built-in perks like upgraded boardings, a $75 annual travel credit and a 7,500-point anniversary bonus easily make up for it. You may even come out ahead.

Official application link: Southwest Rapid Rewards Priority Credit Card

Additional reporting by Ryan Wilcox, Benét J. Wilson, Jennifer Yellin, Joseph Hostetler, Christina Ly and Ryan Smith.