Delta SkyMiles Reserve Amex card review: Loads of perks plus a 90,000-mile offer

Posted by admin on

Delta SkyMiles® Reserve American Express Card

The Delta SkyMiles® Reserve American Express Card provides complimentary Sky Club access when flying on Delta, as well as the ability to earn Medallion Qualification Miles and a Medallion Qualification Dollar waiver through spending on the card. The Delta Reserve Amex is best suited for frequent flyers who want Delta-specific perks, including lounge access, a boost toward elite status and a domestic companion certificate after each account anniversary. Card rating*: ⭐⭐⭐½

*Card rating is based on the opinion of TPG’s editors and is not influenced by the card issuer.

Whether you’re traveling for work or leisure, having airport lounge access allows you to be more productive while traveling and provides a place to relax before or between flights (and grab a quick drink or snack).

While plenty of travel credit cards provides airport lounge access, if you mainly fly with Delta, you’ll want to get into its Delta Sky Club lounges. Luckily, one of the primary benefits on the Delta SkyMiles Reserve American Express Card is complimentary access to Delta Sky Clubs when flying Delta. So, if you were thinking about springing for a Sky Club membership, you’ll probably be better off paying the Delta Reserve’s $550 annual fee (see rates and fees) instead and enjoying both lounge access as well as other advantages to boot.

Aside from lounge access, the Delta Reserve Amex offers many other perks that may be useful to frequent Delta travelers. For example, Delta Reserve cardmembers can hit Medallion elite status a bit easier by spending on the card. They also enjoy free checked bags and priority boarding privileges when flying the airline.

It’s also offering a welcome bonus of 90,000 bonus miles after you spend $6,000 in purchases on your new Card in your first six months of account opening. Offer ends March 29.

Here is a closer look at the Delta Reserve Amex and its benefits so you can decide whether it’s the right card for you.

Who is this card for?

Amex designed the Delta Reserve Amex for frequent Delta flyers. In particular, Delta flyers who spend a lot of money on the airline will enjoy its bonus earning opportunities, while those who want to qualify for a specific Delta elite status tier can earn bonus MQMs and an MQD waiver from spending on the Delta Reserve Amex. Delta loyalists considering purchasing a Delta Sky Club membership may also find that applying for the Delta Reserve Amex is a better use of their money.

However, it’s essential to realize that the Delta Reserve Amex isn’t the fastest way to rack up rewards, even when frequently flying on the carrier. Instead, the Delta Reserve Amex is best suited for travelers who can get significant value from the card’s outsized perks.

Related: Choosing the best credit cards for Delta flyers

Current welcome offer

The Delta Reserve Amex is awarding 90,000 bonus miles after you spend $6,000 in purchases on your new Card in your first six months of account opening if you’re a new applicant. Offer ends March 29.

TPG’s valuations peg Delta SkyMiles at 1.41 cents each, making 90,000 bonus miles worth a whopping $1,269.

However, some applicants won’t be eligible for this welcome offer. Specifically, due to Amex’s one-bonus-per-card-per-lifetime rule, you typically won’t qualify if you currently have this card or had previous versions in the past. Amex may also consider the number of American Express cards you’ve opened and closed as well as other factors when determining whether to offer you a welcome bonus.

Thankfully, Amex will tell you if you aren’t eligible for the welcome offer after submitting your application but before Amex pulls your credit. So if you’re hoping to snag the welcome bonus, pay attention to any messages or warnings that show up after you apply.

Related: What credit score do you need to get Delta SkyMiles cards?

Main benefits and perks

The Delta Reserve Amex offers several useful perks for frequent Delta flyers. However, Delta loyalists who want lounge access when flying Delta will certainly benefit the most. Let’s take a closer look at all of the Delta Reserve Amex’s perks and benefits.

Lounge access

Quite simply, lounge access is the main reason to have the Delta Reserve Amex instead of another Delta credit card.

With the Delta Reserve Amex, primary and additional cardmembers get complimentary access to Delta Sky Club lounges when traveling on a same-day, Delta-marketed or Delta-operated flight. Cardmembers can also pay a fee of $50 per person per location for Sky Club access when traveling on a Delta partner airline flight not marketed or operated by Delta.

Cardmembers also get two one-time Sky Club guest passes upon account opening and each year upon account renewal. These guest passes will appear in your Wallet in the Fly Delta app. You can also pay $50 per person per location to bring up to two guests or immediate family (spouse or domestic partner and children under 21 years of age) with you into the Sky Club.

What’s more, the Delta Reserve Amex will also get you into American Express Centurion Lounges for free when flying Delta with a ticket purchased on a U.S.-issued American Express card. You can bring up to two guests into the Centurion Lounge with you for a fee of $50 per person per location.

Annual companion certificate

Another major benefit of the Delta Reserve Amex is the companion certificate that cardmembers receive each year after their account anniversary. The companion certificate is valid for one round-trip ticket in first class, Delta Comfort+ or Main Cabin for a companion when you purchase one adult round-trip. You just have to pay the taxes and fees (no more than $80) on the second ticket.

Travel must occur within the 48 contiguous United States, unless you live in Hawaii, Alaska, Puerto Rico or the U.S. Virgin Islands. You can only book tickets in the following fare classes, too:

- First class: I and Z.

- Comfort+: W and S, but only when L, U, T, X or V classes of service are available in the main cabin.

- Main Cabin: L, U, T, X and V.

Depending on what you redeem your companion ticket for, you could use it to save hundreds or even thousands of dollars each year, especially if you fly first class.

Earn MQMs and an MQD waiver

New cardholders are given Status Boosts which can help you earn 15,000 MQMs after spending $30,000 on your card in a calendar year and an additional 15,000 bonus MQMs after spending $60,000, $90,000 and $120,000 in a calendar year. So you can take home up to 60,000 MQMs each calendar year by spending $120,000 on your card.

Delta Reserve Amex cardmembers can also earn an MQD waiver based on their spending activity. Those who make $25,000 or more in purchases on their card in a calendar year get an MQD waiver for Silver, Gold or Platinum Medallion status (Diamond requires $250,000 in a calendar year). This can really come in handy if you fly enough to meet the airline’s MQM or Medallion Qualification Segment requirements, but not the MQD one — especially since Delta rolled over all MQMs earned in 2021 to 2022.

Related: The ultimate guide to getting upgraded on Delta

Other perks

The Delta Reserve Amex extends many other travel-related perks, including:

- First checked bag free: First checked bag free for you and up to eight companions traveling with you on your reservation when you check in with Delta for both a Delta-marketed and Delta-operated flight (codeshare flights are not eligible).

- Priority boarding: Main Cabin 1 priority boarding for you and up to eight companions traveling with you on the same reservation when flying on Delta- and Delta Connection-operated flights.

- 15% discount on award flights: 15% off award redemptions for Delta flights (when paying taxes and fees with this card)

- 20% back on inflight purchases: Get 20% back as a statement credit for eligible prepurchased meals and inflight purchases of food, alcoholic beverages and audio headsets on Delta-operated flights.

- Global Entry/TSA PreCheck fee credit: Get a statement credit every four years for a Global Entry application fee charged to your card, or every 4½ years for a TSA PreCheck application fee charged to your card (up to $100).

- No foreign transaction fees (see rates and fees).

The Delta Reserve also includes extensive shopping protections and travel coverage when you use your card for certain purchases.

How to earn miles

As you might assume from its name, the Delta Reserve Amex earns Delta SkyMiles as follows when you make eligible purchases with the card:

- 3 miles per dollar on eligible purchases made directly with Delta.

- 1 mile per dollar on all other eligible purchases.

But even with 3 miles per dollar on airfare, you may not want to spend much on the Delta Reserve Amex after you’ve earned the welcome bonus (unless you’re trying to hit a threshold for bonus MQMs or a MQD waiver). That’s because, based on TPG’s valuation of Delta miles at 1.41 cents each, you’ll get about a 4.7% return on Delta purchases and a 1.6% return on everything else. You can do better, especially if you consider some other American Express cards that earn Membership Rewards points that you can then transfer to Delta.

In short, the Delta Reserve Amex is not a card that you get for its earning potential. Even if you’re a frequent Delta flyer, you’ll come out ahead by charging your airfare to one of the best cards for airfare purchases, such as The Platinum Card® from American Express.

The Amex Platinum offers 5 Amex Membership Rewards points per dollar spent on airfare purchases when you book directly with an airline or through Amex Travel (on up to $500,000 on these purchases per calendar year). Then, you can transfer Amex Membership Rewards points to Delta at a 1:1 ratio if you choose, or you can utilize one of the issuer’s 18 other airline partners. So not only is your earning potential higher; you’re also not tied to a single frequent flyer program.

Related: 4 reasons why the Amex Platinum might be the ideal credit card for Delta flyers

How to redeem miles

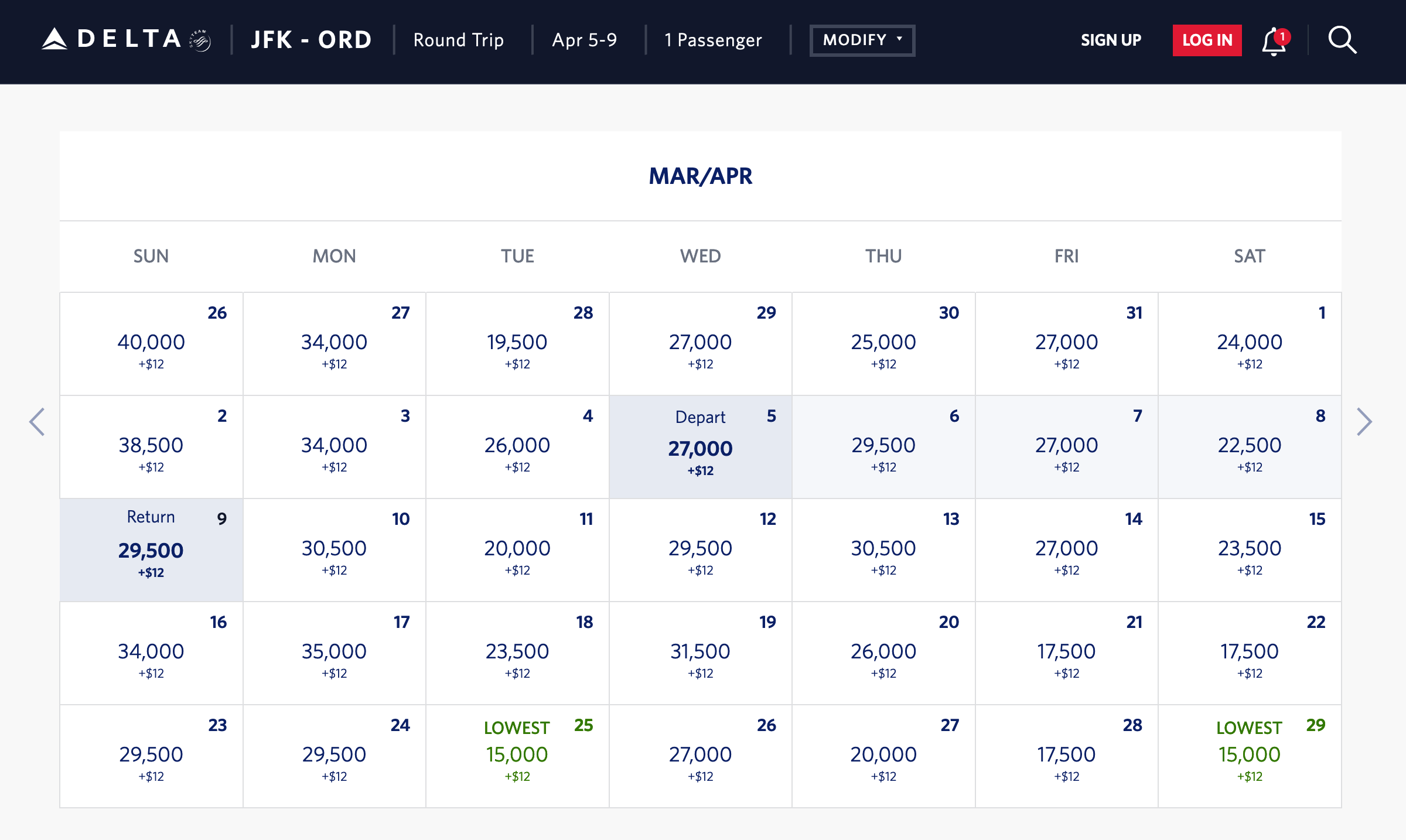

Delta’s decision to pull its award chart several years back and switch to variable pricing can make it frustrating to redeem Delta SkyMiles. The effects of variable pricing can be mild in some cases, like this month of round-trip flights between New York (JFK) and Chicago-O’Hare (ORD). Delta highlights the lowest economy class fare of 15,000 miles in this example, but many other dates have significantly higher pricing.

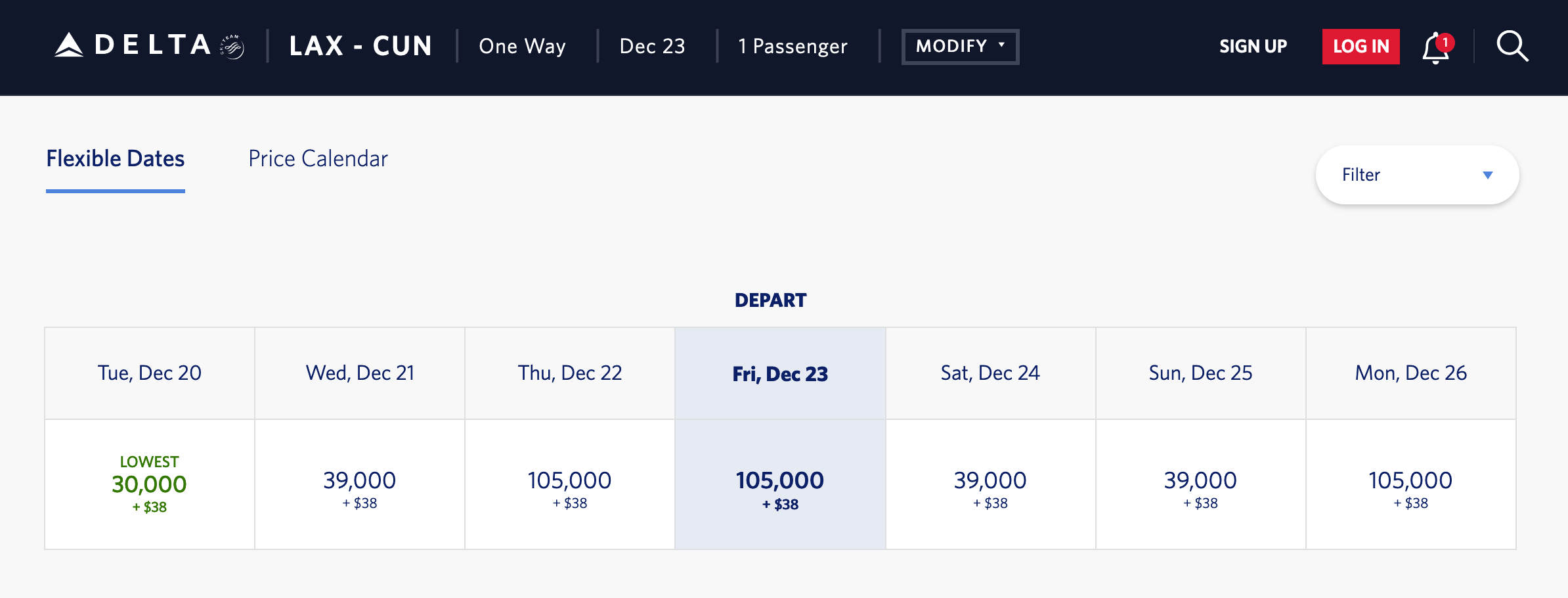

The price fluctuation gets more intense when you start to look at holiday travel, such as these one-way, economy awards between Los Angeles (LAX) and Cancun (CUN) around the holidays.

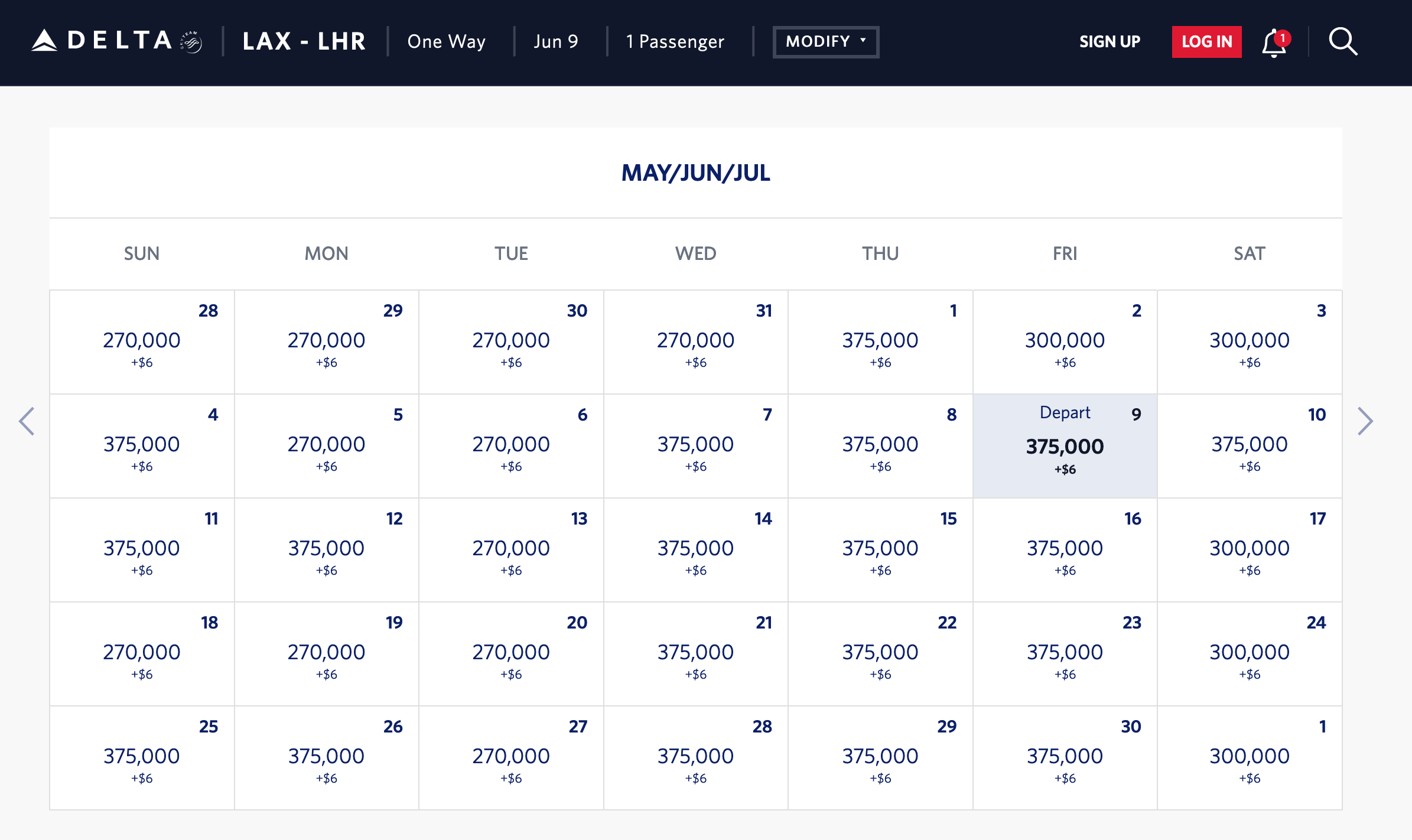

And when you start talking about premium-cabin awards, prices can skyrocket. You can almost certainly do better than these one-way awards between LAX and London-Heathrow (LHR) when booking with other programs for next year.

If you have the flexibility to do so, you’d be better off saving your Delta miles for one of the carrier’s frequent flash award sales. In the past, we’ve seen deals for domestic awards from 2,000 SkyMiles each way and New York to Bogota, Colombia, in business class from 12,000 SkyMiles each way. You can also use your SkyMiles to fly on international SkyTeam partner airlines such as Air France and Korean Air, as well as select non-alliance partners like Virgin Atlantic and WestJet.

You can redeem Delta SkyMiles for many things other than flights, too — including premium alcoholic beverages in Sky Clubs as well as hotels and rental cars. However, note that some redemption options may provide relatively low value.

Related: 9 Delta SkyMiles sweet spots worth saving up for

Which cards compete with the Delta Reserve Amex?

Most Delta Reserve Amex cardmembers carry it for two reasons: Delta Sky Club access and an extra boost toward earning Delta elite status. When it comes to these perks, the Delta Reserve Amex has three primary competitors:

- The Platinum Card from American Express.

- Delta SkyMiles® Platinum American Express Card.

- Delta SkyMiles® Reserve Business American Express Card.

In this section, I’ll discuss each of these three cards so you can ensure you get the right card for you.

Amex Platinum

Some frequent Delta flyers might be better off applying for The Platinum Card from American Express instead of getting a Delta credit card.

After all, the Amex Platinum offers 5 Membership Rewards points per dollar on airfare purchased directly with the airline (a 10% return based on TPG’s valuations) compared to the Delta Reserve Amex’s 3 miles per dollar spent on eligible Delta purchases (a 4.7% return). And you can still transfer Membership Rewards points to Delta SkyMiles at a 1:1 ratio.

The Amex Platinum offers Sky Club access when flying Delta in addition to a Priority Pass Select membership, access to Amex’s expanding collection of Centurion Lounges and the entire American Express Global Lounge Collection. Enrollment is required for select benefits.

Although the Amex Platinum has a $695 annual fee (see rates and fees), it comes with many luxury travel perks, including complimentary Hilton and Marriott Gold elite status and access to the Fine Hotels & Resorts program. Plus, the Amex Platinum provides up to $200 in annual Uber Cash (for U.S. services) and up to $200 in annual airline fee statement credits, as well as up to $100 in annual Saks Fifth Avenue statement credits and up to a $100 credit every 4½ years to cover a Global Entry or TSA PreCheck application fee. Enrollment is required for select benefits.

It’s true that you won’t get Delta-specific perks such as a first checked bag free, priority boarding, or help qualifying for Medallion status with the Amex Platinum. But you can select Delta as your airline for the annual airline fee statement credit and then use this credit to cover up to $200 in fees (including baggage fees) each calendar year.

The Amex Platinum currently offers a welcome offer of 80,000 Membership Rewards points after spending $6,000 on purchases in your first six months of card membership — though you may be targeted for an even higher offer through the CardMatch Tool (offer subject to change at any time).

For more details, check out our Amex Platinum card review.

Related: Credit card showdown: Amex Platinum vs. Delta Reserve

Delta Platinum Amex

Suppose you want a Delta SkyMiles card for the Delta-specific perks but don’t think you’d use the Delta Reserve Amex’s most valuable benefits, namely lounge access and the first-class companion certificate.

In that case, you should consider the more moderately priced Delta SkyMiles Platinum American Express Card. The Delta Platinum Amex is offering a welcome bonus of 90,000 bonus miles after you spend $4,000 in purchases on your new Card in your first six months of account opening.

The Delta Platinum Amex offers the same MQD waiver options, first checked bag free and priority boarding as the Delta Reserve Amex. But, the Delta Platinum Amex won’t get you complimentary Delta Sky Club access, although you can pay for admission on a per-visit basis.

On the other hand, the Delta Platinum Amex has a lower annual fee of $250 (see rates and fees) that may be easier to justify for some consumers. It, too, comes with an annual companion ticket with the similar stipulations to the Delta Reserve, though this one is only good for main cabin L, U, T, X and V fare buckets (thus excluding Comfort+ and first class).

For more information, see our card review of the Delta Platinum Amex.

Related: Credit card showdown: Delta Platinum vs. Delta Reserve

Delta Reserve Business Amex

Finally, if you’re eligible for a business card, you might prefer the Delta SkyMiles Reserve Business American Express Card.

This business card has a lot of similarities to the consumer version. In particular, the lounge access, companion certificate, MQD waiver, ability to earn MQMs by hitting spending thresholds, first checked bag free and priority boarding perks are all the same for the Delta Reserve Amex and Delta Reserve Business Amex. It also has the same $550 annual fee (see rates and fees).

However, the Delta Reserve Business Amex is available with a slightly higher welcome offer 100,000 bonus miles after you spend $6,000 in purchases on your new card in your first three months of card membership.

As a result, a business owner with a lot of spending in a given year could do very well with this card.

See our Delta Reserve Business Amex card review for more details.

Related: Delta elite status match offered to targeted Amex cardholders

Bottom line

The Delta SkyMiles Reserve American Express Card represents a strong commitment to Delta. In particular, this card is best for Delta loyalists who want complimentary Delta Sky Club access and a serious elite qualification boost.

But, if you don’t need both of these Delta-specific perks, another card might be better for you. For example, the Amex Platinum is a stronger choice if you’re only interested in Delta Sky Club lounge access when flying Delta. And Delta credit cards with lower annual fees are preferable if you need less of an elite qualification boost or are primarily interested in getting your first checked bag free and priority boarding.

Apply for the Delta SkyMiles Reserve American Express Card

For rates and fees of the Delta Reserve Amex, click here.

For rates and fees of the Amex Platinum, click here.

For rates and fees of the Delta Platinum Amex, click here.

For rates and fees of the Delta Reserve Business Amex, click here.

Additional reporting by Emily Thompson, Ryan Wilcox, Ethan Steinberg, Eric Rosen and Christina Ly.