6 award chart ‘sweet spots’ that will save you money on domestic flights

Posted by admin on

The key to maximizing your transferable points and airline miles is knowing the best redemption sweet spots. Admittedly, many of these sweet spots are international business class awards to far-flung destinations in Asia, Europe, the Middle East and elsewhere. But, it’s not hard to find excellent deals on domestic awards if you know where to look.

Here, I’ll show you the six best domestic award chart sweet spots. These span several programs and can help you save on flights on all the major U.S. airlines. Better yet, you can book most of them with popular transferable points programs from American Express, Chase and others.

Get the latest points, miles and travel news by signing up for TPG’s free daily newsletter.

In This Post

1. Cheap award tickets to Hawaii

Hawaii is a reader favorite here at TPG, and thankfully, there is are a slew of ways to get there with points and miles. Here are a few of our favorite ways to book flights to Hawaii on the major U.S. carriers.

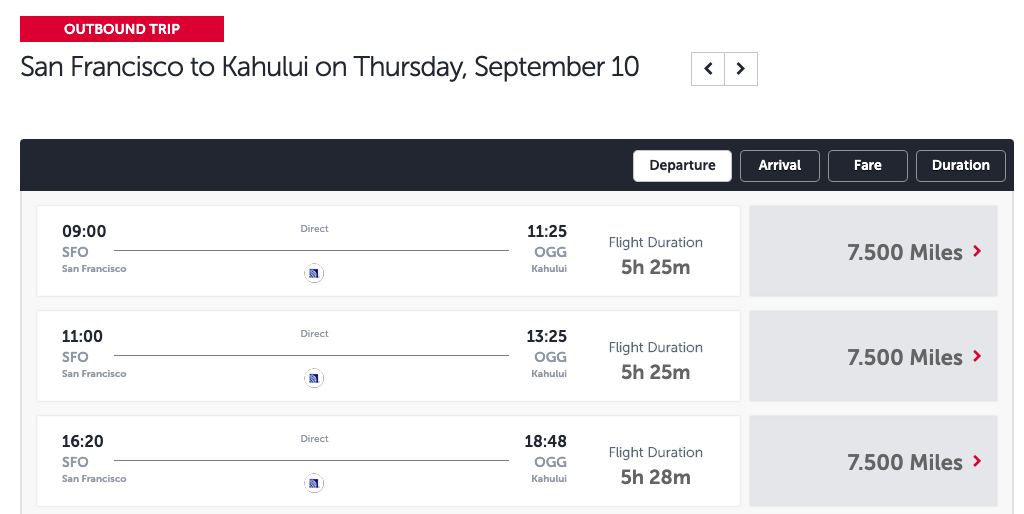

The best ways to book United flights to Hawaii

The best flight deal to Hawaii is to book United flights with Turkish Airlines Miles & Smiles. This Star Alliance loyalty program charges just 7,500 miles for a one-way flight from anywhere in the U.S. to Hawaii. Better yet, a business class ticket is just 12,500 miles one-way, but award space is challenging to find.

The only downside to Miles & Smiles is that points are relatively challenging to earn. You can transfer points in from Citi ThankYou and Capital One Rewards. Unfortunately, Capital One miles transfer in at a 2:1.5 ratio.

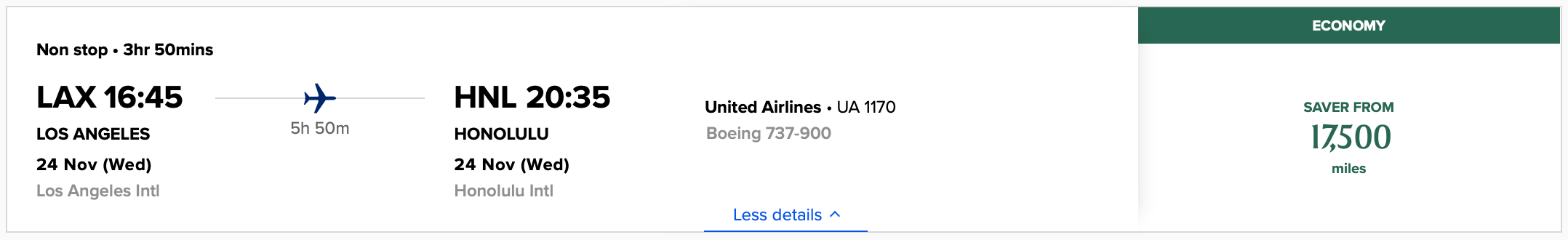

Alternatively, those with American Express Membership Rewards and Chase Ultimate Rewards points can book United flights to Hawaii through Singapore Airlines KrisFlyer. This program charges 35,000 miles for a round-trip economy ticket from anywhere in the mainland U.S. to Hawaii.

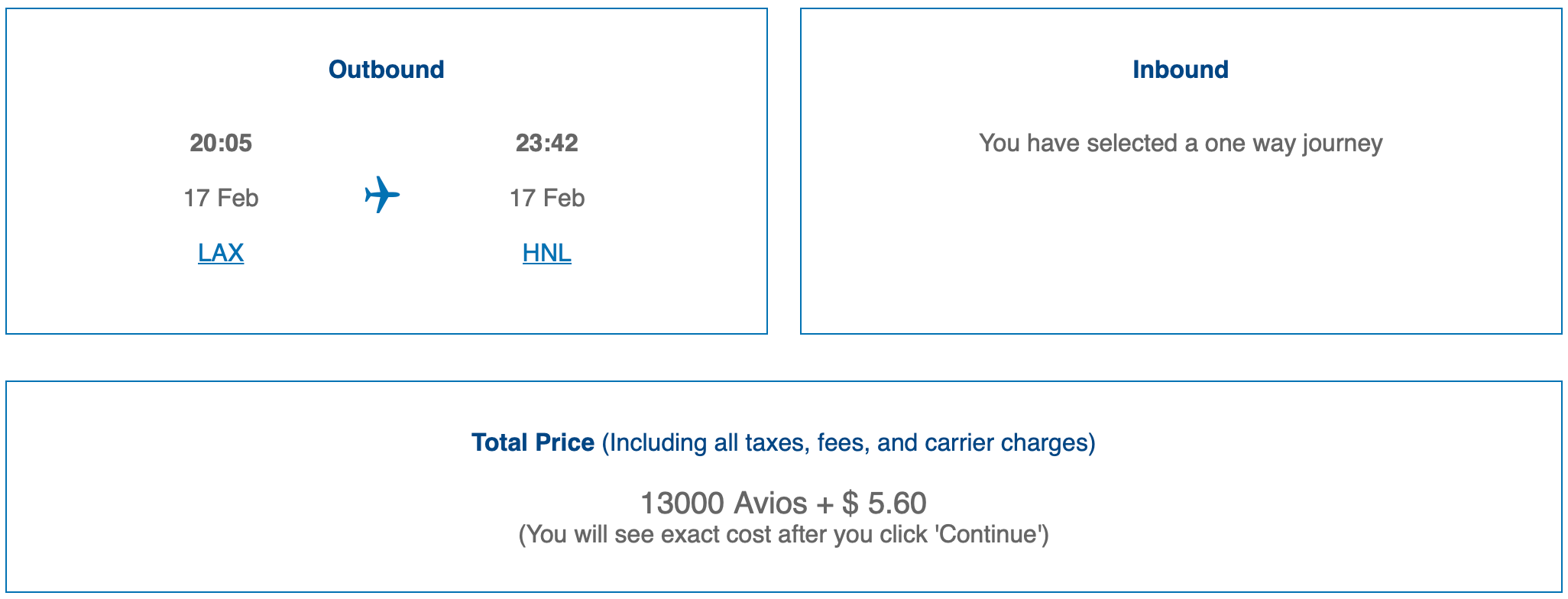

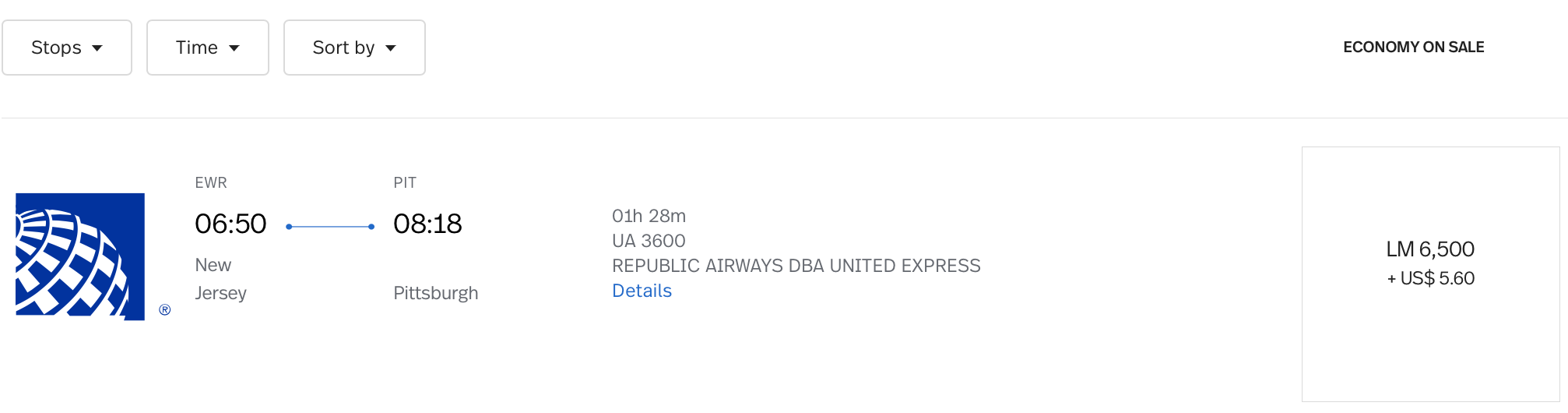

Book American Airlines or Alaska Airlines flights with Avios

You can use British Airways’ distance-based award chart to fly American or Alaska Airlines from the West Coast to Hawaii for 13,000 Avios each way in economy. Between these two carriers, you’ll find extensive routing options to most Hawaiian destinations.

You can transfer Amex, Chase and Capital One points to British Airways. Like Miles & Smiles, Capital One miles transfer to British Airways at a 2:1.5 ratio.

Always look for good deals on Southwest flights

Finally, Southwest launched flights to Hawaii in 2019 and has steadily expanded its route network over time. You can often find low-cost points and cash deals to Hawaii on the carrier, making it an exceptional value for those with a Companion Pass. You can top-up your Southwest Rapid Rewards balance with a Southwest cobranded credit card or transferring points from Chase.

Related: My top 5 things to do in Oahu, Hawaii

2. United flights with Turkish Miles & Smiles

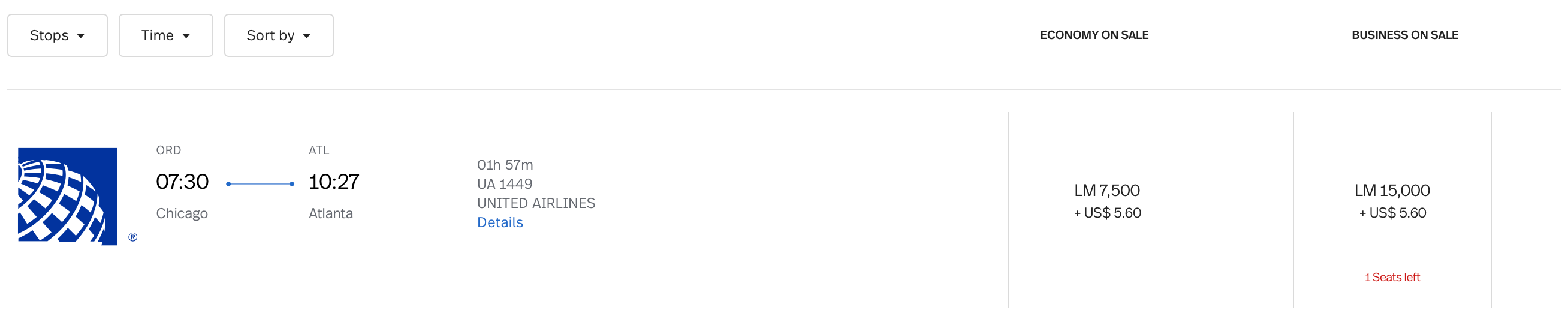

Turkish Miles & Smiles is one of the most underrated airline mileage currencies out there. Just like flights to Hawaii, the program charges just 7,500 and 12,500 miles one-way for United domestic flights in economy and business class, respectively. Yes, this even includes transcontinental flights with lie-flat seats.

This is by far the lowest price we’ve seen for domestic award tickets on mid and long-haul domestic routes. You can book most United awards on Turkish’s website, but it takes some getting used to. Read our complete guide to Miles & Smiles for a full run-down.

Related: Book This, Not That: Star Alliance award tickets

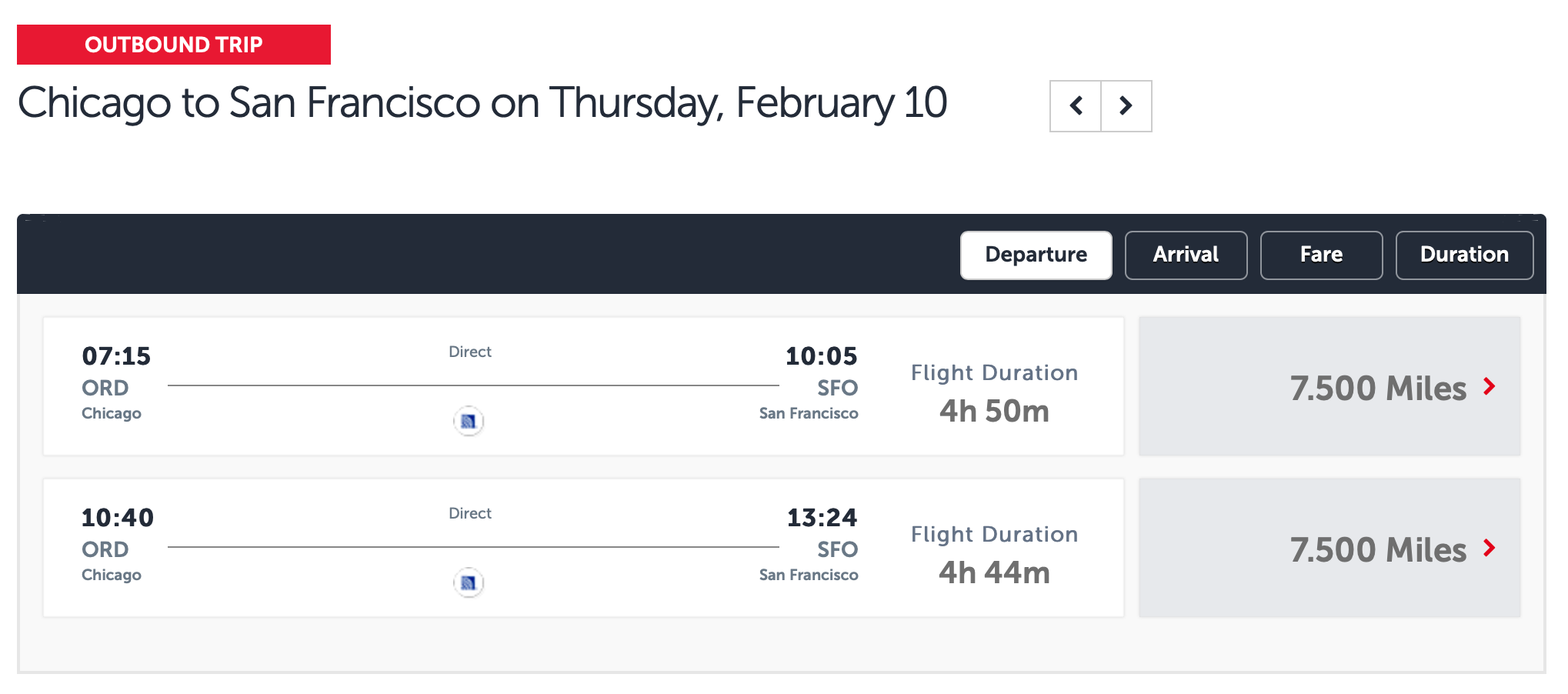

3. Redeem Amex points for United flights with LifeMiles

While Avianca LifeMiles uses a standard, zone-based award chart, it splits the U.S. into different award zones. These three zones roughly map to the East Coast, Midwest and West Coast. United flights that stay entirely within one zone only cost 7,500 LifeMiles each way in economy.

For example, you can fly from Chicago-O’Hare (ORD) to Atlanta (ATL) for only 7,500 miles.

LifeMiles also has lower-than-normal award prices on some routes. You can book Newark (EWR) to Pittsburgh (PIT) for 6,500 LifeMiles one-way. Keep an eye out for these lower-cost awards when you’re looking for LifeMiles award flights.

You can transfer Amex, Capital One and Citi ThankYou points to Avianca LifeMiles. LifeMiles are the best way to redeem Amex points for domestic United flights.

Related: 3 reasons your family needs LifeMiles for domestic travel

4. British Airways Avios for short-haul American and Alaska Flights

Even outside of flights to Hawaii, you can use British Airways Avios to score an excellent deal on domestic flights on American and Alaska Airlines.

Remember, British Airways uses a distance-based award chart. It prices each segment of an award separately, so you’ll want to stick to nonstop flights whenever possible. Typically, you’ll get the most bang for your buck on short flights. American and Alaska-operated flights up to 651 miles long cost 7,500 Avios one-way, while flights between 651 and 1,151 miles cost 9,000 Avios. This is often cheaper than booking the short-haul awards with American’s AAdvantage program.

Prefer to fly in style? You can stretch your Avios even further by booking domestic lie-flat seats with your Avios. American is flying internationally configured planes flying dozens of domestic routes while international travel demand is low due to the coronavirus pandemic. One of the most popular routes is New York-JFK to Miami (MIA), where you’ll find some frequencies operated by the airline’s flagship Boeing 777-300ER.

You can book a business class ticket on this route for just 16,500 Avios one-way, giving you a great way to experience American’s best business class product.

Related: Three versions of Avios: When to use Aer Lingus, Iberia and British Airways

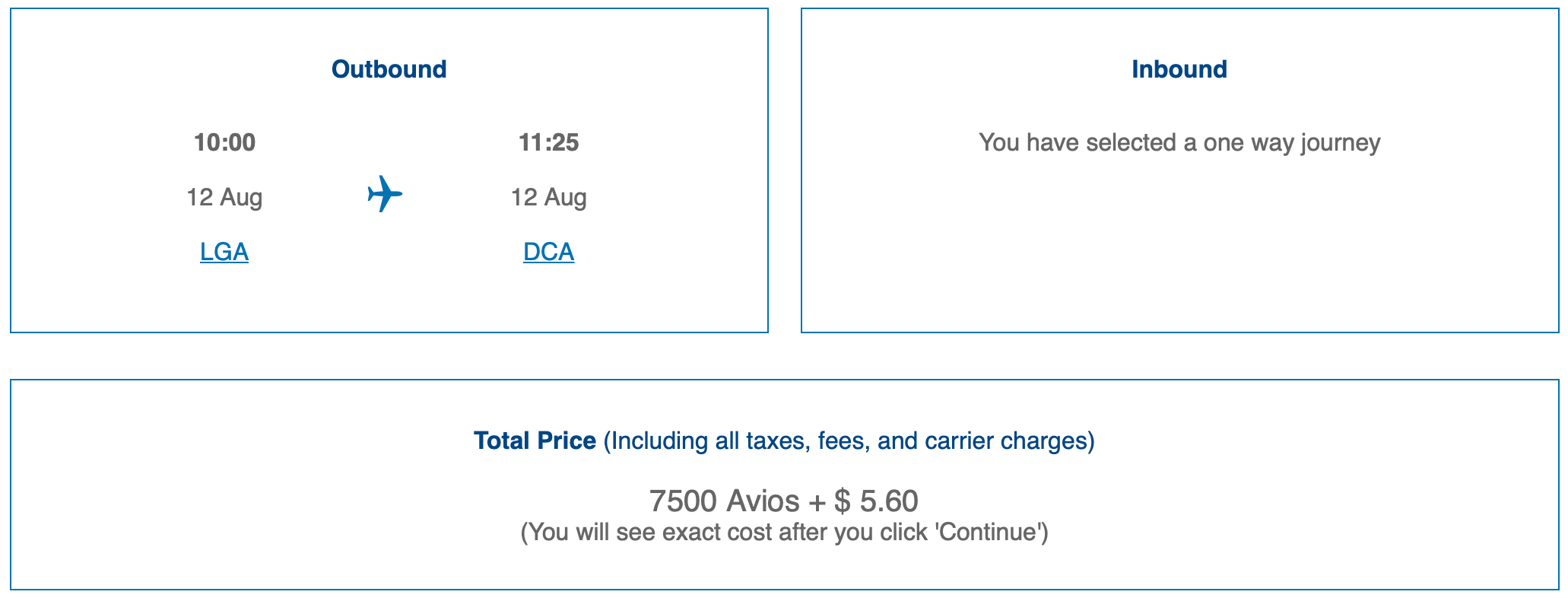

5. Low-cost Delta SkyMiles Awards around the country

The Delta SkyMiles program often gets a bad rap. The airline pulled its published award charts years ago and switched to variable pricing, skyrocketing the cost of many awards in the process. The price you see on any given day is the price you pay, just like a cash ticket. In turn, this leaves the door open for sudden devaluations and, in practice, makes it hard to redeem SkyMiles for high-value international flights.

However, Delta recently started to offer excellent deals on domestic flights. You can often find one-way domestic flights for as low as 4,500 SkyMiles one-way, like this flight from Chicago to Minneapolis (MSP).

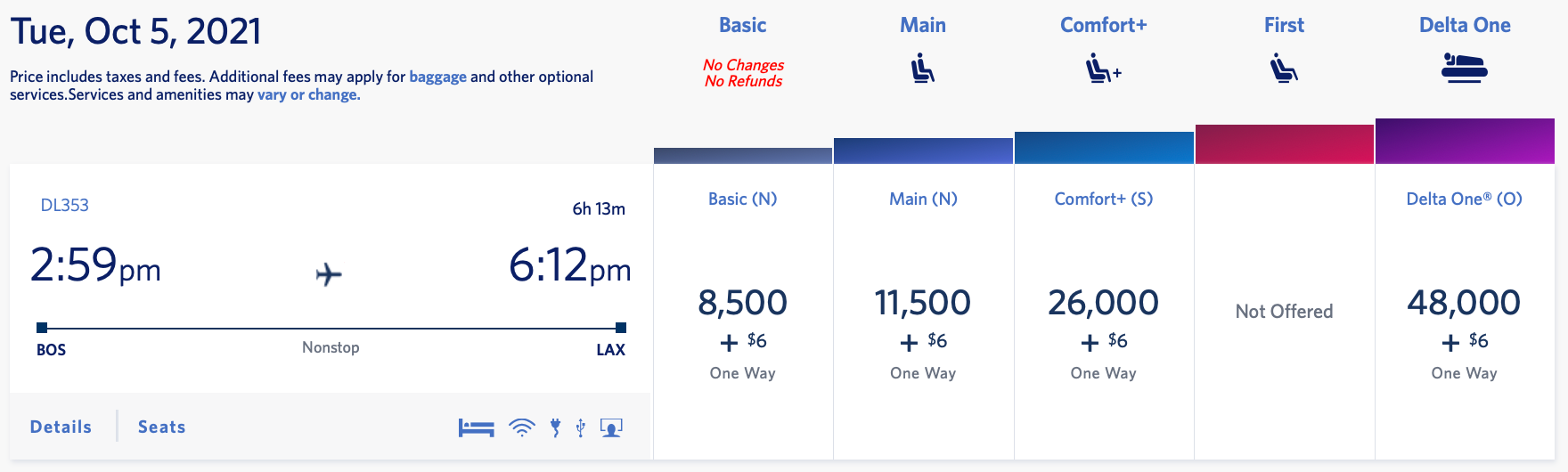

You can even find transcontinental flights for cheap. For example, you can book Boston (BOS) to Los Angeles (LAX) for as few as 9,500 SkyMiles in basic economy on many dates this fall. This is an exceptional deal for one of the nation’s longest domestic routes.

Keep an eye out for published Delta Flash Sales too. In the past, we’ve seen domestic flights price as low as 2,500 SkyMiles in basic economy. You can transfer Amex points to Delta or earn with a Delta cobranded credit card.

Related: Everything you need to know about maximizing Delta SkyMiles award tickets

6. Consider using American Airlines Reduced Mileage Awards

One of the biggest perks of holding an American Airlines cobranded credit card is access to AAdvantage Reduced Mileage Awards. These awards let you save up to 7,500 miles (or 3,750 off one-way tickets) on some short-haul travel around North America.

Reduced Mileage Awards are available when your award either departs from or arrives at a participating airport, and these airports rotate each month. American publishes a list of airports every couple of months, giving you a short window of time to lock in these awards. You can see a complete list of eligible airports on this page.

For example, August 2021’s airports include Atlanta, Austin (AUS), Boise (BOI) and Charleston (CHS), among many others. As a general rule, You should always check the list of Reduced Mileage Awards before booking any domestic American travel. Just note you have to call to book these awards.

You must have one of the following credit cards to take advantage of the full discount:

- Citi® / AAdvantage® Executive World Elite Mastercard®

- Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

- CitiBusiness® / AAdvantage® Platinum Select® Mastercard®

- AAdvantage Aviator Red Mastercard

- AAdvantage Aviator Business Mastercard

- Other credit cards listed here are no longer open to new applicants.

The information for the Citi AAdvantage Platinum and CitiBusiness AAdvantage Platinum Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

You can save a smaller 5,000 miles on select round-trip award tickets (or 2,500 off one-way) if you have one of the following cards listed here that are no longer open to new applicants.

If you’re a domestic travel fan, it may be worth keeping an American cobranded credit card in your wallet for Reduced Mileage Awards alone.

Related: How to redeem miles with the American Airlines AAdvantage program

Credit cards that can help you stock up on points

You might have noticed that traditional, U.S.-based loyalty programs don’t offer the bulk of awards listed. However, it’s important to know that transferable point currencies can give you easy access to these niche programs, making these sweet spots possible for American travelers.

With these programs, you’re not locked into a single carrier and its award rates. You can select the airline that offers the best award rates to minimize the number of points you need to transfers. Plus, many of the cards that earn these points offer category bonuses on popular spend categories, like dining and groceries.

Here’s a rundown of the top cards for earning each of the transferable programs.

Related: Why transferable points are more valuable than ever

American Express Membership Rewards

American Express Membership Rewards points are my favorite transferable points currency. It has the most extensive list of transfer partners, including Avianca LifeMiles, British Airways Avios, Singapore Krisflyer and others. I’ve gotten tens of thousands of dollars in value from my Membership Rewards points over the years on both international and domestic tickets.

Here’s a look at some of the best American Express card offers:

- American Express® Green Card: Earn 30,000 Membership Rewards points after you spend $2,000 on purchases within the first three months of account opening. Earn 3x points on dining at restaurants, travel and transit (including flights, hotels, cruises, taxis, tours and more), and 1x points on other purchases ($150 annual fee; see rates and fees).

- American Express® Gold Card: Earn 60,000 Membership Rewards points after you spend $4,000 on eligible purchases with your new card within the first six months of account opening. Earn 4x points on dining at restaurants, 4x points at U.S. supermarkets (on up to $25,000 per calendar year, then 1x points), 3x points on airfare purchased directly from airlines or American Express Travel, and 1x points on other eligible purchases ($250 annual fee; see rates and fees).

- The Platinum Card® from American Express: Earn 100,000 Membership Rewards points after spending $6,000 on purchases in your first six months of card membership. Earn 5x points on airfare purchased directly from airlines or with American Express Travel (on up to $500,000 on these purchases per calendar year), 5x points on prepaid hotels booked with American Express Travel and Amex Fine Hotels + Resorts, and 1x points on other purchases ($695 annual fee; see rates and fees).

The information for the Amex Green card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Redeeming Membership Rewards points for maximum value

Chase Ultimate Rewards

Chase Ultimate Rewards points can be exceptionally valuable too. Transfer partners include British Airways, Singapore KrisFlyer, Southwest Rapid Rewards and many others. Plus, you can use the Chase Ultimate Rewards Travel Portal to book low-cost paid tickets with your points.

Here’s a look at the best Chase offers:

- Chase Sapphire Preferred Card – Earn 100,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

- Ink Business Preferred Credit Card – Earn 100,000 bonus points after you spend $15,000 on purchases in the first three months from account opening.

- Chase Sapphire Reserve – Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

Related: Best sweet spots with Chase Ultimate Rewards

Citi ThankYou Rewards

Citi ThankYou is one of the lesser-known transferable points programs, but it can be incredibly powerful. You can transfer Citi points to programs like Turkish Airlines Miles & Smiles and Avianca LifeMiles. Consider opening a Citi Premier® Card to earn these points. The card currently offers its best-ever signup bonus of 80,000 ThankYou bonus points after spending $4,000 on the card within your first three months of account opening.

Related: Here’s how you can earn 80,000 points on the Citi Premier card

Capital One Rewards

Capital One Rewards was massively improved earlier this year when it added a slew of new transfer partners, including British Airways Avios and Turkish Miles & Smiles. It also enhanced transfer ratios to Avianca LifeMiles and other programs. These changes make the Capital One Venture Rewards Credit Card even more valuable, especially since it earns 2 miles per dollar spent on all purchases.

New cardholders can earn 100,000 bonus miles after spending $20,000 on purchases within the first 12 months of account opening or still earn 50,000 miles after spending $3,000 on purchases within the first three months of account opening.

Related: 5 incredible sweet spots of Capital One’s revamped transferable miles program

Bottom line

After reading this article, you should know how to score an excellent deal on domestic flights operated by all the major American carriers. Bookmark this page and refer to it the next time you need to book domestic travel — it could save you thousands of points.

For rates and fees of the Amex Green card, click here.

For rates and fees of the Amex Gold card, click here.

For rates and fees of the Amex Platinum card, click here.

Ethan Steinberg contributed to this post.

Feature photo by IVAN KUZKIN / Shutterstock.com