16 Best Small Business Payroll Software in 2022 [Ultimate Guide]

Posted by admin on

There are many different types of payroll software. Some are more advanced than others; some are better for smaller businesses and some are better for large businesses.

To help you understand how to choose the right payroll software and how it can help your business, we’ve put together a list of the best payroll software options out there today.

What Is The Best Payroll Software?

Payroll software is an accounting program that automates the process of calculating payroll taxes, deductions, and payments.

In other words, it makes it easy to pay employees on time, accurately, and legally.

Some vendors offer both payroll and HR software in one bundle while others offer separate products for each function.

Some vendors offer both cloud-based and desktop versions of their software so that you can pick which works best for your business needs.

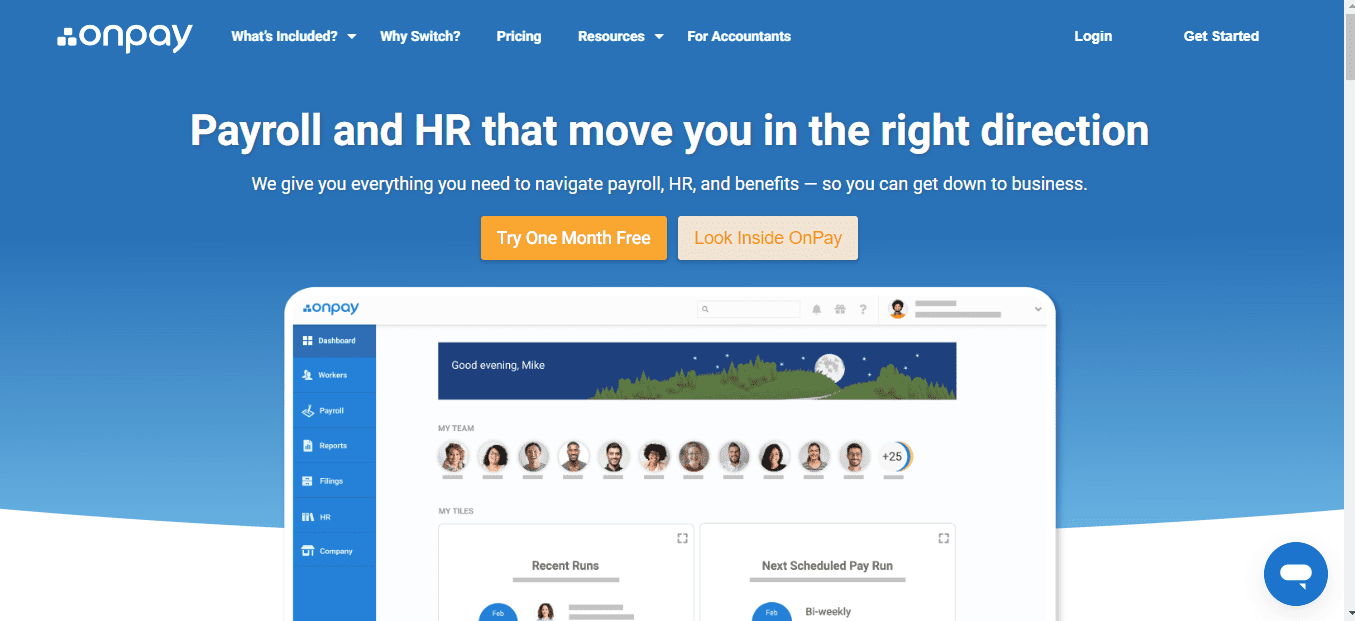

1. OnPay

You can save money by comparing payroll software quotes. The cost of payroll software varies widely, depending on the features you need and the program’s complexity.

Most payroll software systems fall between $200 and $2,000 per employee per year — a small price to pay when you consider how much time and money they’ll save you.

If you have more than 20 employees or if your business is growing fast, it’s worth considering enterprise-level solutions that offer more comprehensive features and support.

These products can cost as much as $10,000 per employee per year — but they’re designed for businesses with multiple locations, complex reporting needs and large teams of employees who need high levels of customization.

Before you buy any software package, compare its price with other programs that might suit your needs better.

Best For:

OnPay is a payment platform that allows clients to accept credit card payments, debit card payments and ACH transactions for free. It also offers a wide range of other features, such as inventory control, eCommerce integration and employee management.

OnPay’s pricing model is based on the number of transactions users process through their accounts. The company charges $9 per month for up to 200 transactions, $36 per month for up to 1,000 transactions and $90 per month for up to 3,000 transactions.

There are no additional fees or setup costs. OnPay Best For Small businesses that want a flexible payment processing solution with minimal monthly fees

Key Features:

OnPay is a mobile payment app that enables users to pay for their purchases using their mobile phones. The app is available on both iOS and Android devices.

OnPay allows users to make payments via their smartphones, without the need to carry cash or credit cards around. This can be very convenient when you do not have your wallet with you, or if you do not want to risk losing these items.

With OnPay, you can also make payments from anywhere in the world, as long as you have an internet connection.

OnPay Key Features:

The following are some of the key features of OnPay:

- PayPal-like functionality

- Highly secure transactions

- Support for multiple currencies (USD, EUR, GBP etc.)

- Instant account setup

- Quick and easy registration process

Pros:

OnPay is a cloud-based point-of-sale system that allows you to accept credit cards and electronic checks at your business. It’s loaded with features and is easy to use, but there are some drawbacks you should be aware of before signing up.

OnPay Pros

OnPay offers many features that make it an attractive alternative to other POS systems: Cloud-based software No need to install or configure anything on your computer.

Simply sign up for an account, download the software and start accepting payments immediately. Easy setup — OnPay uses standard hardware, so there’s no need to buy expensive equipment or upgrade existing equipment.

Just plug in the device, enter your settings and start taking payments right away. Customizable payment forms — Payment forms can be customized with logos, colors, fonts and images to match your business’s branding.

There are also built-in templates available if you don’t want to get creative with your forms’ design. No per transaction fees — OnPay charges a flat monthly fee instead of charging per transaction like some other payment processors do.

That makes it ideal for businesses that need a lot of transactions each month but don’t want to pay extra each time someone buys something from them.

Cons:

OnPay Cons:

-The only way to cancel your account is by contacting support. I tried to cancel my account by logging into my account, but the option was not available.

-They do not have a physical address listed online, so there is no way to send them a letter or write them a complaint. -You cannot use PayPal with Onpay. You have to have a credit card on file in order to make payments.

This can be problematic if you don’t have any credit cards or you are trying to close an account and you don’t want them to keep charging your credit card every month.

Cost:

OnPay is a great way to save money on your fuel purchases. It’s easy, convenient, and most importantly, it saves you money.

OnPay is a prepaid card that you fill up with your own money. Then, when you need fuel, just swipe the card and go! No more trips to the gas station or waiting in line for the pump.

You can even use OnPay at any location that accepts MasterCard Debit Cards! The best part about OnPay is that there are no monthly fees or activation fees – ever! You pay nothing unless you use it.

When you fill up with $25 worth of fuel, we’ll give you an extra $1 in free fuel! That’s $26 worth of fuel for only $24!

2. ADP Payroll

ADP offers a full range of payroll processing services that make it easy for you to manage the payroll requirements of your business.

ADP Payroll Services include:

Payroll Processing – Our payroll experts can handle all aspects of your payroll, including processing, tax filing and remitting. Wage and Tax Data – We provide you with up-to-date wage and tax data so you can be confident that your employees are paid accurately and on time.

Payroll Tax Services – We’ll help you determine which workers are eligible for which tax deductions so you can get the biggest refund possible from the IRS. 401(k) Plan Administration – We provide plan administration services for 401(k) plans, including plan design, setup, recordkeeping and compliance with federal regulations.

Best For:

Adp Payroll is the best payroll software for small businesses. This payroll solution is designed to be simple, easy to use and affordable.

It’s perfect for small business owners who want a payroll system that doesn’t require a lot of training and support. If you need help setting up or using your payroll software, contact us at 800-926-6044.

ADP Payroll has been around for decades and is one of the most popular payroll solutions for small businesses. The software runs on Windows PCs and can be used by anyone with basic computer skills.

You don’t need any prior experience with accounting or payroll systems to use this program successfully. The ADP Payroll Best For solution includes everything you need to run an effective payroll operation:

Easy Setup: Set up your company and employees quickly with just a few clicks of the mouse. All you need is an email address and phone number for each employee.

Automated Tax Calculations: Never worry about calculating payroll taxes again! The ADP Payroll Best For program automatically calculates federal and state taxes as well as Social Security tax liability based on data provided by your employees during set-up or when they’re hired

Pros:

ADP Payroll Pros is a payroll service that simplifies payroll processing and helps businesses automate the payment of taxes and benefits.

ADP Payroll Pros offers a range of services, including:

– Payroll processing

– Timekeeping

– Electronic filing of employment tax returns

– Federal and state unemployment insurance

– State disability insurance

– 401(k) plans

Cons:

The ADP payroll system is a great way to get started with payroll. But there are some cons that you should be aware of before you make the switch.

1) Cost

The cost is one of the biggest drawbacks of using ADP Payroll. It’s not cheap! You’ll have to pay $50 per month per employee and it goes up from there.

You’ll also need to pay for services like direct deposit and tax filing, which will add to your costs as well. If you’re only paying one or two employees, it might be worth it to go with a cheaper service like Gusto or OnPay.

However, if you have more than a few employees, then ADP Payroll becomes much more affordable.

2) User Experience

ADP Payroll’s user experience leaves something to be desired. It’s not impossible to navigate through all the different pages and forms required by ADP but it can be confusing at times.

The interface hasn’t been redesigned in ages so it looks outdated and not very intuitive at first glance. The support team is also very slow in answering questions or helping out with problems so keep this in mind if you’re looking for support while using ADP Payroll!

Cost:

ADP payroll cost is a big concern for the small business owner. ADP is one of the most popular payroll services for small businesses, but it does come with a price.

ADP Payroll Cost

The cost of using ADP as your payroll provider depends on how much you pay per employee. The more employees you have, the higher your monthly fee will be.

Keep in mind that if you have fewer than 25 employees and are eligible for payroll tax deductions, you can use a free service like Quickbooks Self-Employed to manage your paychecks.

ADP has three levels of pricing:

Basic — $10 per employee per month. This option is best suited for smaller businesses with fewer than 10 employees.

Professional — $15 per employee per month.

This option is best suited for businesses with 11–100 employees or those who need additional features such as direct deposit, direct debit and 401(k) plans.

Advanced — $20 per employee per month plus $2 per check; this option includes everything from Professional but also includes retirement planning advice from Financial Engines®, one of the largest independent financial advisory firms in the nation (Financial Engines® charges 0% annual fee on balances less than $50,000).

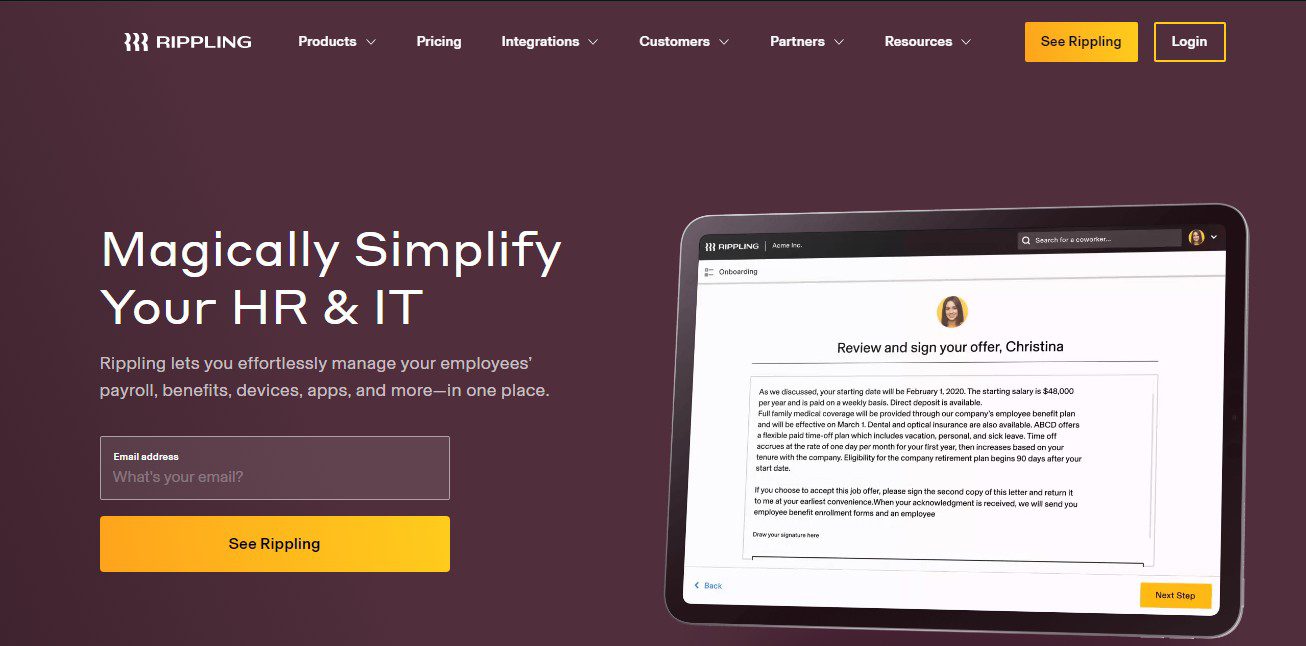

3. Rippling

Rippling is a phenomenon that occurs in a subset of individuals who have undergone the Lightning Process, a therapeutic technique for treating chronic pain and other conditions. Rippling is the perception of “ripples” of light, color or sound that radiate across one’s visual field.

These may occur spontaneously, or can be evoked by certain stimuli such as music or emotional states. Rippling is often accompanied by tingling sensations throughout the body.

The Lightning Process was developed as an alternative to conventional medical treatments for chronic pain and illness by British osteopath Phil Parker and his wife Julia Parker. The method involves a series of exercises designed to retrain the brain using neuroplasticity principles, with the goal of reducing stress levels and promoting healing.

The technique has been promoted as a possible treatment for fibromyalgia, multiple sclerosis, chronic fatigue syndrome (ME/CFS), autism spectrum disorder (ASD) and other conditions.

It has also been used by people without any diagnosed medical condition, who claim that it results in improvements ranging from enhanced mental clarity to weight loss.

Best For

Are you looking for the best ripple mattress?

Well, we have compiled a list of the best ripple mattresses that are currently available in the market. We have listed them in order of their overall performance.

Rippling Best For is one of the most comfortable and durable mattresses on the market. It has been designed to provide optimal comfort and support for your body.

The manufacturer uses advanced technology in making this product and it shows in every aspect of its design. The mattress has been made with a combination of different materials which work together to provide you with a firm and soft sleeping surface.

Its unique structure also ensures that there is no sagging or sinking when you lie down on it. This will help prevent back pain as well as other related conditions caused by poor quality mattresses.

The Rippling Best For is available in four different sizes: full, queen, king, and California king size. This means that there is an option for everyone no matter what size bed you want or need to purchase this mattress for! You can also choose from six different color options which makes it easy for you to find a style that matches your bedroom decor perfectly!

Key Features

Rippling Features

- Easy to use, secure and fast solution for sending money abroad. You can send money to India, USA, Canada, UK, UAE and other countries.

- Lowest fee in the market with $1 as the lowest fee when sending to India from US.

- There are no hidden charges or fees with Rippling Money Transfer.

- A secure platform for sending money abroad with 256-bit SSL encryption technology that ensures all your personal information is safe and secure at all times.

- Real-time tracking of your transfer on your mobile phone or computer at any time via the Rippling website or app.

Pros

Rippling is a new way to share your content with friends. You can send images, videos, or even links to friends directly from the app.

Rippling Pros

– Easy and fast way to share your images and videos with your friends.

– You can also show off your favorite videos, images and links on social media sites like Facebook and Twitter instantly.

– Rippling has a built-in web browser so you don’t have to go anywhere else for internet surfing.

– The application supports multiple languages (English, French, German, Italian, Spanish).

Cons

Rippling cons are the most common type of cons. They’re perpetrated by people who have been victims of rippling cons themselves and want revenge.

Their goal is to pass on their pain to someone else. Rippling cons are usually pretty easy to spot, but they’re not always easy to avoid.

For example, in some cases it can be hard to tell whether someone is legitimately trying to help you or if they’re just trying to steal from you again (and again).

Every con has ripple effects: It hurts everyone involved — people like you who get cheated, and people like me who try to stop them from cheating others.

Cost

Rippling cost is the additional expense that a company incurs to manage a crisis. This cost can be in the form of monetary compensation or lost brand equity, depending on the severity of the crisis.

Companies can prevent rippling costs by having an effective crisis management plan in place. Rippling cost is also known as ripple effect, domino effect or contagion effect.

Crisis Management Plan The purpose of a crisis management plan is to minimize the impact of a crisis on a company’s reputation and bottom line. In order to do this, companies need to assess their risk exposure and develop strategies for managing all types of crises.

The plan should address how to react when faced with a crisis as well as provide guidance on preparing for one.

A good crisis management plan will include:

An analysis of potential threats and opportunities;

A list of possible responses;

A timeline for action;

Roles and responsibilities for each person involved; and

A description of how external parties will be informed about the crisis when necessary

4. Patriot

Patriot is a brand of memory modules and flash storage products, as well as computer peripherals. It is a subsidiary of Patriot Technologies, a global corporation headquartered in Fremont, California.

Patriot’s main products are DRAM modules (commonly known as RAM), USB flash drives and SSDs (solid state drives) for PCs and laptops. The company also produces flash cards for mobile devices, SDHC cards, MMC cards, CF cards and SDXC cards.

Patriot was founded in 1985 by Johny Chow as a computer store servicing local businesses in the Silicon Valley area of Northern California.

In 1988, Patriot began selling memory upgrades for personal computers through its mail order catalogs. The company expanded its product line to include computer peripherals such as hard drives and optical drives in 1995.

In 2000, Patriot acquired competitor NetFuzion Corporation which allowed it to expand into new markets such as enterprise storage solutions for small businesses and home office users.

In 2009 Patriot released its first solid state drive offering PC enthusiasts an alternative to traditional mechanical hard disk drives (HDD). The following year their first USB 3.0 drive was released followed by their first portable external drive that same year. In 2012 Patriot

Best For:

Patriot Best For is the best way to protect your data. Patriot’s Best For line of Solid State Drives (SSDs) offers a secure and easy way to upgrade your computer and get the performance boost you need.

Patriot’s drives are built to withstand the rigors of everyday use while providing fast, reliable storage and transfer speeds. The Data Protection Plan provides protection against a variety of unexpected circumstances that may affect the health of your drive.

This plan covers mechanical breakdowns, electrical failures, accidental damage, and other occurrences. This plan also includes 24/7 emergency support and free shipping both ways on all repairs covered under the plan.

Key Features:

- In-app Chat

- In-app Messaging

- In-app Invoicing

- Customizable Invoices

- Payment Plans

- Pricing Tables

- Subscription Plans & Billing Cycles

Pros:

Patriot Pros is a full service residential and commercial cleaning company. Our team of professionals has been trained to provide our customers with the highest quality of service..

We have many years of experience and our management team has over 30 years in the business. We are family owned and operated, so we take pride in every job we do.

We are also licensed, bonded, insured and have been certified by IICRC (Institute of Inspection Cleaning and Restoration Certification).Our goal is to provide you with a safe, clean environment that will be conducive to your health, safety and well-being.

We offer a wide range of services including:

Residential Cleaning Services

Commercial Cleaning Services

Move In / Move Out Cleaning Services

Cons

Patriot Cons is a list of non-partisan, non-profit, pro-America organizations. The mission of Patriot Cons is to provide the public with a list of ethical businesses who support our country and its people.

Patriot Cons wants to help you find companies that are doing good things for you, your family and your community. We invite you to share your experiences with these companies so that we can add them to our list!

We are not affiliated with any political party or candidate. We are non-partisan and non-profit. All donations go toward creating this site and paying for hosting fees.

Cost

Patriot Cost is the cost of purchasing a Patriot card. The Patriot card is a device that is used to purchase things online, in stores or over the phone.

When you sign up for a Patriot card, you will be asked to pay $25 as an activation fee and $1 per month for each month you want to use your Patriot card. f you do not use your card for more than 2 years, then it will be canceled automatically.

Patriot Cost also includes any additional service fees that are charged by your financial institution when you use your Patriot Card. For example, if there is a fee for using your debit card at an ATM machine or making purchases at a store where credit cards are accepted, then this would be included in your Patriot Cost.

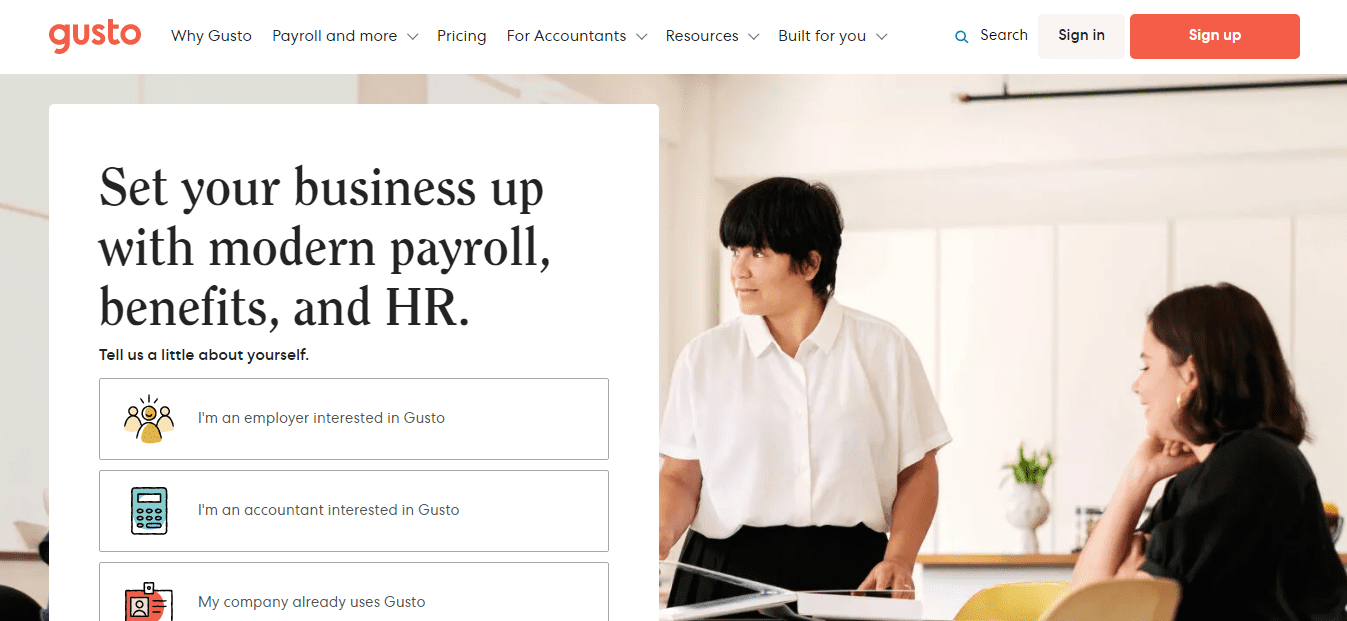

5. Gusto

Gusto is the best payroll software for small businesses. In fact, we’ve been named one of America’s fastest growing private companies by Inc.

Magazine for two years running. We’re a team of more than 200 people who believe in great company culture and work hard to make Gusto an amazing place to work.

We’re also proud to be recognized as a Best Place to Work by the San Francisco Business Times and Glassdoor Employees’ Choice Awards.

Our mission is simple: make it easy for small businesses to run payroll so they can focus on what matters most — their customers and the work that makes them successful.

Best For

Gusto Best For is a payroll and benefits program that helps small business owners save time and money. usto Best For is designed for businesses with less than 10 employees.

It offers simple, affordable payroll, tax filing and benefits administration so you can focus on running your business.

All of our plans include: Payroll – Gusto calculates and pays your employees’ payroll taxes (FICA, Medicare, etc.) every week. You get the W-2s, 1099s and other forms you need to file with the government right away.

Employee Benefits – We make it easy for you to offer health insurance, 401(k) plans and more to your employees. We provide all the tools needed to enroll, manage and pay claims for any benefit plan you choose including:

Health Insurance

Dental Insurance

Vision Insurance

Short-Term Disability Insurance

Key Features:

Gusto is a cloud-based payroll and employee management software that helps small businesses manage their team with ease.

Gusto Key Features:

- Affordable and easy to use, Gusto is the most affordable payroll solution on the market.

- It’s free for one employee and $49/month for up to 100 employees.

- Payroll done right, Gusto does payroll tax calculations automatically so you don’t have to worry about getting it wrong, saving you time and money.

- Payroll reports made easy, Gusto provides instant access to all your payroll reports in one place so you can view them any time you need them without having to wait for them in an email or postal mail.

- Easy setup process, Gusto has an extremely easy setup process that will have your company set up within minutes! Once you have signed up for your account all you need is your bank account information and your employees’ social security numbers and they are good to go!

Pros

Gusto is an online payroll service that makes it easy for small businesses to manage payroll and taxes. The platform offers a suite of tools, including automated payroll, tax filing, benefits management and more.

Gusto Pros are the company’s professional services team that help customers with their payroll needs.

Gusto Pros can help businesses with every aspect of handling payroll, including:

- Setting up employees and pay rates

- Setting up new employees and pay periods

- Setting up new jobs and tax codes

- Adding new employees to Gusto

- Reporting on employee hours and wages paid

Cons

Gusto has a lot going for it. It’s easy to use, has great customer service and its pricing is competitive.

But there are some downsides that may make Gusto not worth it for your business. Let’s take a look at the pros and cons of using Gusto payroll:

Pros

Easy to use interface: The interface for Gusto is intuitive and easy to navigate, even for new users who haven’t used payroll software before. If you ever have questions about how something works, Gusto has videos on their website that explain everything from setting up your account to paying employees.

And if you ever have a problem with your account or need help with something, you can always reach out to their customer service team by phone or email — which we found to be very responsive and helpful in resolving issues. Competitive pricing: Gusto offers several plans with different pricing tiers depending on the size of your company (up to 1,000 employees).

We tried out the most popular plan for startups which costs just under $100 per month for up to 50 employees and includes payroll processing, tax filing services and health care benefits administration. You can also choose from other plans if you have more employees or

Cost

Gusto is a company that offers payroll and benefits for small business owners. The company was founded in 2012 and is headquartered in San Francisco, California.

Gusto has raised $112 million from investors including Sequoia Capital, Google Ventures and Social Capital. As of February 2018, Gusto has 500 employees and is used by more than 30,000 businesses with over 100 employees.

Gusto Cost

The cost to use the service depends on your business size and the number of employees you have. For example, if you have fewer than 20 employees and want to use its payroll services, you’ll pay $20 per month per employee (plus an additional $15 per month for each employee who receives health insurance through the service).

This amount includes all taxes and other fees associated with payroll processing (such as federal unemployment tax). There are also no setup fees or hidden charges involved with using this service.

6. SurePayroll

SurePayroll is a payroll service for small businesses in the U.S., Canada, and Australia.

SurePayroll offers a variety of payroll services to help small businesses manage their finances, including employee time tracking, payroll and tax filing services.

The company was founded in 2004 by Mike Beresford, who previously served as chief operating officer at HR software company Intuit and CEO of accounting software company Cloud Accounting Solutions.

[1] SurePayroll is headquartered in Palo Alto, California and has additional offices in Chicago, New York City and Belfast, Northern Ireland.[2] SurePayroll has received $40 million in venture capital funding from investors including Sequoia Capital and Benchmark Capital Management.[3]

Best For

Best For: Employers looking for a payroll service that’s easy to use and affordable. SurePayroll offers both payroll and benefits administration, making it a one-stop shop for small and medium-sized business owners.

The company offers several plans depending on your company size, with the most popular being the Pro plan ($12 per employee per month). The company offers many features that are similar to other payroll providers, including direct deposit and paperless paystubs.

However, one of SurePayroll’s biggest strengths is its ability to integrate seamlessly with popular accounting software like QuickBooks Online or Xero. This makes it easier for small businesses to avoid costly data entry errors and streamline their entire financial operations process in general.

Key Features

SurePayroll is a payroll service that enables you to run payroll for your company. It offers many features that make it easier for business owners and their employees.

SurePayroll Key Features:

- Easy Setup. The setup process is easy, so you can get started on time without hiring an accountant or learning complicated software.

- Transparent Fees. There are no hidden fees, so you know exactly what you’ll pay each month to run your payroll.

- Mobile-Friendly App. Run your payroll anywhere with the mobile-friendly app, even offline!

- Free Training and Support.

- We offer free training videos and live support to help you get up and running in no time!

SurePayroll is a payroll service that offers online accounting and payroll services. The company is based in Chicago, Illinois, and was founded in 2006 by Joel Libava and Bob Meese. The company has more than 300 employees and currently serves more than 6,000 clients nationwide.

SurePayroll Features

The SurePayroll services include basic payroll processing, garnishments, direct deposit, tax reporting & filing, employee benefits (401(k) plans), workers compensation insurance, unemployment insurance, FICA tax compliance and other related services.

SurePayroll offers its customers an online portal where they can access their account information any time they need it. This portal also allows employees to update their personal information as well as review their pay stubs from anywhere in the world through any device with internet access.

Accounting Services: The SurePayroll accounting services include year-end tax preparation for all federal state & local taxes including 1099-MISC W2 1099-INT & 1098 forms for both business owners and employees.

These services are available at no additional charge to customers who sign up for SurePayrol’s basic payroll processing service package.

Pros

- It’s a great payroll service for small businesses. 2. It’s the easiest way to pay and manage your employees’ payroll taxes, benefits and more.

- It’s free for up to three employees!

It’s free for small businesses and freelancers. It’s very easy to use, with an intuitive interface.

You can pay your employees online, or via direct deposit or check. It’s easy to set up recurring payroll payments for employees.

You can track hours in real time and send notifications when employees clock in and out of work. There are no hidden fees or charges associated with using SurePayroll. Cons:

SurePayroll is only available in some states (see above), so if you operate outside of those states, this may not be the best option for you.

The customer support team is available only during business hours on weekdays and weekends, so if you need help during off hours you’ll have to wait until Monday morning before reaching someone at SurePayroll.

Cons

SurePayroll is a great payroll service, but it’s not the only one out there. While it can be used by small businesses and freelancers, it’s not necessarily the best option for everyone. Here are some of SurePayroll’s cons:

Inability to customize invoices. SurePayroll doesn’t allow you to customize your invoices at all.

If you want to change things like fonts or colors, you’ll need to use a different option. Not available in every state. While SurePayroll is available nationwide, it doesn’t work for everyone in every state.

California, Louisiana and New York don’t allow you to use this service unless you’re a nonprofit or government entity that provides benefits for employees such as health insurance or retirement plans.

Limited number of employees supported by each plan type:The Freelancer plan supports up to 10 employees and costs $9 per month per employee; the Small Business plan supports up to 50 employees and costs $19 per month per employee; and the Enterprise plan supports up to 250 employees and costs $49 per month per employee.

Cost

Many companies operate as S corporations, limited liability companies, or partnerships. That means that they don’t have to pay payroll taxes on their employees’ wages.

Instead, they do their own calculations and file a quarterly Form 941 with the IRS. But what if you’re a small business owner who wants to automate the process of calculating payroll taxes?

Or maybe you want to make sure that your company is paying the right amount of unemployment tax? Or maybe you just want to be able to take advantage of direct deposit for your employees’ paychecks?

SurePayroll is one of several online payroll services that can help you with all of these tasks — and more!

What does SurePayroll do?

SurePayroll’s service offers many advantages for small businesses: Automated payroll calculations – SurePayroll calculates your employee’s taxable wages and deductions according to federal and state regulations.

Your employees can also sign up for direct deposit, which means that they don’t have to worry about losing a check in the mail or having it bounce due to insufficient funds in their checking account. Unemployment tax reporting – If you are required by law to withhold unemployment taxes from your employees’ paychecks and remit those funds to state agencies on a regular basis, then Sure

7. Intuit Enhanced Payroll Software

Intuit Enhanced Payroll Software is a payroll solution that helps small business owners and self-employed individuals manage their payroll. It can be used to prepare and file federal and state payroll tax returns, as well as manage employee information and paychecks.

The software offers features that make it easier for you to run your business, including: Easy setup. You can complete the setup process in minutes, using an electronic form with questions about your company’s structure, employees’ names and Social Security numbers, and their wage information.

Simple employee data entry. You can enter employee names, addresses, Social Security numbers, dates of hire and other information quickly by typing or keying in data fields on the screen.

The software will automatically calculate deductions from paychecks based on your selections from drop-down menus for each employee’s status (hourly or salary), type of deduction (pre-tax or after-tax) and whether the deduction is based on gross or net pay.

You can also add deductions for 401(k) contributions or health insurance premiums by using a similar process for entering employee information. Automated calculations. The software does all the calculations for you — so you don’t have to worry about making mistakes when calculating taxes or benefits

Best For

Intuit Enhanced Payroll Software. Small business owners with up to 100 employees that want a full-service payroll solution, including tax filing and reporting.

Intuit Enhanced Payroll Software.Small business owners with up to 100 employees that want a full-service payroll solution, including tax filing and reporting.

Intuit Enhanced Payroll Software. Small business owners with up to 100 employees that want a full-service payroll solution, including tax filing and reporting.

Intuit Enhanced Payroll Software. Small business owners with up to 100 employees that want a full-service payroll solution, including tax filing and reporting.

Key Features

Intuit Enhanced Payroll Software is designed to manage all aspects of payroll, including tax filing, benefits management and HR compliance. This comprehensive solution is easy to use and offers a number of features that make it an ideal choice for small businesses looking for an affordable way to manage their payrolls.

The software includes everything you need to set up and manage your company’s payroll process, whether you have one employee or thousands. The following are some of the key features included in Intuit Enhanced Payroll Software:

-Easy Setup with Simple Questions

-Automated Tax Calculations

-Employee Self Service Portal

-Full Audit Trail Reports

Pros

It’s a software that can be accessed anywhere, anytime. It is a cloud-based solution which means that you don’t need to have the software installed in your computer.

The only thing you need is an internet connection and you can access the software from any location. It is very convenient and easy to use. There are no complicated terms or procedures involved when using this software.

It has been designed to be user-friendly so that even newbies will find it easy to use. It also comes with an online customer support service which you can use anytime you get stuck with something or have a question about something.

Intuit Enhanced Payroll Software Cons:

There are some disadvantages associated with using this software like having limited features or not being able to customize it according to your needs and preferences, but if all you want is just a simple payroll system, then this software is perfect for you.

Cons

The product is very expensive. The price is $199.99/month and $999.99/year; here is no free trial available to try it out before buying;

Intuit Enhanced Payroll Software is not a software that can be used in any country or state; It only works with payrolls in the United States of America, Canada, and Australia;

– Intuit Enhanced Payroll Software. is not a perfect system. There are some cons of this software.

The most important part of the system that it does not support all types of companies, so there are many limitations in this software. Some companies use multiple payrolls and it is difficult to manage them with this software.

It is also difficult to use by people who have no experience in this field and need training on using it. Some features are missing which can be very helpful for small businesses, like direct deposit and tax filing options.

This software has a lot of limitations and drawbacks that make it less attractive than other similar products available in the market today.

Cost

Intuit Enhanced Payroll Software. Cost: $30 per month Intuit Enhanced Payroll Software is designed to be used by business owners and bookkeepers who have specific needs, such as tracking time worked by employees, managing bonuses, and paying employees on a biweekly basis.

It’s not the best option for small businesses with less than 20 employees because it doesn’t offer everything you need in a payroll software program — but it does the job if you want to cover the basics.

Intuit Enhanced Payroll Software includes features like:

Wage reminders

Paycheck distribution notifications

Direct deposit support

Save by Comparing Payroll Software Quotes

There are many payroll software options available for businesses of all sizes, but finding the right one can be a challenge. You don’t want to be stuck with an expensive or complicated system that doesn’t meet your needs.

Fortunately, there are plenty of ways to save by comparing payroll software quotes. Here are just a few suggestions Get recommendations from other business owners.

If you know someone who has recently switched payroll software, ask them about their experience and what they liked or disliked about the product. Their feedback will help you find a solution that fits your needs and budget. Look at reviews online.

There are plenty of online reviews available for most products including payroll programs. If you can find some positive comments on these sites, it’s likely that others have had good experiences as well — which means they may also be willing to share information with you!

Search for discounts and promotions online. Some providers offer discounts or free trials when you purchase online, so be sure to look through these offers before making your decision on which company to go with.

8. Sage Payroll Essentials Plus

Sage Payroll Essentials Plus. Sage Payroll Essentials Plus is a payroll software for small businesses and freelancers. It delivers all the basic features that you need to run your payroll, in a single package.

The software includes everything you need to run your payroll, including:

– Payroll processing

– Tax returns

– Time & attendance tracking

– P60s

Sage Payroll Essentials Plus is our payroll software solution for businesses with multiple employees. Sage Payroll Essentials Plus is the perfect solution for businesses with multiple employees who want to simplify their payroll and save money.

It is easy to use and integrates seamlessly with Sage Accounts, so you can get paid faster and avoid late payment fines.

Benefits of Sage Payroll Essentials Plus:

Easy to use payroll software

Easy set up – no IT involvement required

No upfront costs or setup charges

No monthly fees or contracts – pay as you go!

Key Features

- Payroll management and reporting – all you need to run your payroll and comply with your legal obligations.

- Flexible benefits – tailor your benefits package to meet the needs of your employees, including flexible benefits such as childcare vouchers.

- Expense claims – track employee expenses, including mileage and travel expenses, so you can reimburse them quickly and easily.

Sage Payroll Essentials Plus.

Key Features:

Manage all your payroll services in one place, including employee attendance and absence tracking, holiday and shift scheduling and pay run management. Automatically calculate National Minimum Wage and Salary Sacrifice Payment calculations.

Full integration with Sage X3 Accounts and Sage X3 Enterprise Management Accounts allows you to manage the entire business from one system. Analysing data in real-time with customisable dashboards helps you keep on top of all aspects of your business performance.

Best For

Sage Payroll Essentials is a complete payroll solution designed for small to medium sized businesses. With this software, you can manage all aspects of your payroll in one place.

You can create and process paychecks, manage employee data and deductions, track wages and hours, calculate taxes and file payroll reports — all from one central location. This product also comes with robust reporting tools that allow you to monitor company-wide information such as hours worked and pay rates.

This allows you to make sure that everyone is being paid fairly based on the work they’re doing at your company.

Pros

The Sage Payroll Essentials Plus software is very easy to use and learn. It has a simple interface that makes it possible for employees to understand how they can interact with the system as well as perform their jobs.

This will help you save on training costs and also reduce downtime due to errors made by employees who do not understand how the system works.

Easy payroll management with payroll data reports The Sage Payroll Essentials Plus software allows you to manage your payroll easily because it offers various reports that will show you all the data about your employees and their payments so that you can know whether or not they have been paid correctly or if there are issues that need addressing immediately.

These reports can also be used in case you need proof of payment in case of disputes with employees or clients who are claiming that they have not been paid properly or on time.

Cons

– High setup costs

Sage Payroll Essentials Plus

Sage Payroll Essentials Plus is not a full-featured payroll solution. It’s a bare-bones product that will only appeal to small businesses with low payroll needs.

If you need more features, you’ll have to upgrade to Sage Payroll Essentials Plus Professional Edition or Sage Payroll Essentials Plus Enterprise Edition.

Sage Payroll Essentials Plus does not cover all states and jurisdictions.

If your company has employees in a state that’s not covered by Sage Payroll Essentials Plus, then you’ll have to upgrade to the Pro version or Enterprise edition of this software.

Cost

Sage Payroll Essentials Plus.

Cost: $250 per month Sage Payroll Essentials Plus is another popular payroll software. Its main features include: Payroll processing and taxes calculations for the U.S., Canada, the U.K., Australia, and New Zealand

Employee benefits (healthcare, retirement, etc.) administration Integration with third-party vendors like Intuit, ADP and Paychex

Sage Payroll Essentials Plus. Cost: $150 per month (based on a 50-employee company)

Sage Payroll Essentials Plus is perfect for small business owners who have employees but don’t want to deal with the stress of doing payroll themselves.

The software includes all the features that you would expect from payroll software, including time tracking, employee scheduling, and benefits management.

You can even integrate Sage Payroll Essentials Plus with other Sage products such as Accounts Receivable or Accounts Payable to streamline your business processes.

Sage Payroll Essentials Plus also offers some advanced features like tax tables for different states and countries so you don’t have to worry about keeping track of all of that information yourself.

The software also has built-in help so if you ever run into an issue with payroll, there are plenty of tutorials that can walk you through the process step by step.

9. Square Payroll

Square Payroll is a robust and affordable payroll service with simple process. It’s easy to get started and get paid on time.

Square Payroll helps you manage your payroll and pay your employees. You can also use it to create custom reports that help you make smart business decisions.

Square Payroll is a full-service payroll solution that includes: Employee management, including hire, promotion, termination, and more Paycheck printing for the employee or direct deposit into the employee’s bank account Employee tax filing and payment Square Payroll is a service that helps you manage your payroll and taxes.

Square Payroll is designed to make it easy to manage payroll, track employee hours, and stay compliant with the law.

To get started, you’ll need a Square account and an approved account holder. You can create or apply for an account at squareup.com/business/register.

Once you’ve completed the application process, you can use Square’s online tools to set up your payroll:

Best For

Small businesses with less than 50 employees. Square Payroll is a payroll service from Square, the company behind the Square Point of Sale system that small business owners use to accept credit cards.

It’s best for small businesses with less than 50 employees that want to automate their payroll and get rid of paper checks. The biggest advantage is that it’s free — you don’t pay any fees or commissions to use Square Payroll, so you only pay for what you use (for example, if your employees are paid hourly, you’ll pay for every hour they’re paid).

It also includes features like direct deposit, which can help save you money on postage and mailing costs. If your business has fewer than 25 employees, there are no monthly fees or setup fees; only one flat rate fee per employee after that (starting at $10/month).

If you have more than 25 employees, there’s a monthly fee starting at $15/month per employee after 25 employees (no setup fee).

Key Features

Easily manage your employees from your phone or computer.

Features include:

– Employee onboarding and offboarding

– Time clock app for employees to clock in and out of work, submit time sheets, and track hours worked

– Online payroll reports for employees and managers to see their W2s, taxes withheld, paystubs, tips earned and more

– Access to employee records: address history, emergency contacts, citizenship status and other key information

The Square Payroll app offers several key features and tools that help manage your business.

Features:

Employee Scheduling: Manage and approve employee schedules, set up shift reminders, and send out scheduling notifications to employees. Time Clock: Record time worked right from the app, or sync with a compatible time clock.

Payroll: Manage payroll quickly and easily with automated tax calculations and direct deposit. Reporting & Analysis: Review reports on all aspects of your business in one place.

Pros

Square Payroll is a payroll service that offers an easy way to manage payroll and taxes. Square Payroll Pros:Easy setup Just sign up for Square, get your account number and set up payroll in minutes.

All the tools you need Use our online dashboard to manage everything from employees to taxes. Get secure access to tax documents and financial reports.

Free first pay period — You only pay after your employees have been paid successfully, with no hidden fees or charges. Flexible setup options — We offer multiple plans depending on your needs, including per-employee pricing, shared user pricing and payroll-as-a-service (PAAS).

Cons

Square Payroll, the payroll software that works with Square Cash, is only available to businesses with fewer than 50 employees. It’s not free — you’ll have to pay $15 per month per employee for the service.

The service also comes with a steep learning curve, especially if you’re new to payroll. Here’s a breakdown of what you need to know before signing up:

The portal is confusing to work with and can be difficult to navigate. The system can also be very slow at times, especially when it comes time to print your W-2s for employees.

There can be a lot of lag time between inputting data and the system updating with the new information. This can cause problems when you need to make changes on the fly and don’t realize it until after you’ve already sent out your payroll checks.

Square Payroll does not have an easy way of tracking hours worked or accrued vacation time for employees, so it’s important that you keep track of this yourself in another program or spreadsheet if you want to avoid mistakes.

Cost

Cost: $20 per month for up to 25 employees.

This is the most popular payroll service among small businesses, with more than 800,000 customers paying for it. The basic service allows you to pay employees by check or direct deposit and also provide them with an electronic pay stub that they can view on their phone or computer.

You can also use this service to send out W-2s and 1099s at the end of the year. You’ll need to enter some basic personal information about each employee like Social Security number and address — but not much else — so it’s easy to set up even if you’re just starting out as an entrepreneur.

If you have more than 25 employees, you’ll need to upgrade to Square’s Premier version of the service which costs $200 per month and includes additional features such as time off tracking, vacation/sick time accrual and automated payroll tax filing (this feature requires a subscription).

10. QuickBooks Payroll

If you need to get paid, QuickBooks Payroll makes it easy to manage payroll in your business. QuickBooks Payroll is the solution for small businesses that want to pay their employees accurately and on time.

It’s designed to help you track and manage your company’s payroll and employee information, so you can focus on running your business.

With QuickBooks Payroll, you can:

Pay employees with one click Track hours worked, taxes withheld and more with a simple interface that shows you all the necessary information at once.

The software also makes it easy to calculate payroll taxes and deductions, so you don’t have to spend hours doing it yourself or pay someone else for it.

Best For

QuickBooks Payroll. Best For Hobbyists Small Businesses (1 to 25 employees) – Quickbooks Payroll is fast and easy to set up.

It integrates seamlessly with your Quickbooks Pro, Premier or Enterprise edition. Large businesses (26+ employees) – Quickbooks Payroll offers advanced features for larger organizations, including multi-company and multi-state payroll processing, direct deposit, and more.

QuickBooks Self-Employed. Best For Freelancers & independent contractors (1 to 10 tax payers) – If you’re self-employed or a freelancer, you may prefer using QuickBooks Self-Employed. It’s designed specifically for the unique needs of self-employed workers who want to track their income and expenses without all the extra work involved in running multiple companies or managing multiple employees.

Key Features

QuickBooks Payroll. Key Features:

Payroll taxes and filings with the government are complicated and time-consuming. You need a payroll solution that makes it easy to manage your payroll taxes and filings, while providing you with the tools you need to run a successful business. QuickBooks Payroll offers:

-Easy setup: Set up your company and employees in minutes with preloaded W2 information.

-Simple management: Manage employee payslips, deductions, tax information and more with just a few clicks.

-Trusted tax filing support: File payroll taxes electronically using Intuit’s TurboTax® tax software or through an accountant or CPA firm.

-QuickBooks Payroll is an integrated payroll solution that gives your business the ability to manage your payroll, taxes and employee information.

QuickBooks Payroll offers a simple way to track payments, deductions and more.

Key Features:

Payee Management – View all of your payees in one place, including employees and vendors, so you can easily see who is paid each pay period. Deductions Management – Create customized deductions for each payee, then record them quickly and accurately with the click of a button.

Tax Settings – Set up tax rates by state or zip code so you can accurately calculate payroll taxes. You can also use the tax estimator tool to quickly project your tax liability based on employee earnings and deductions.

Payroll Tax Filing – File tax forms electronically from within QuickBooks, which means less time spent on paperwork and more time doing what you love!

Pros

- It is very easy to use and can be used by anyone.

- It has an intuitive interface, which makes it easier to use than other software solutions on the market.

- It is integrated with other QuickBooks products, so you can track your payroll data alongside all your other financial information in one place.

- You can schedule payroll quickly and easily using the scheduling tool that comes with QuickBooks Payroll.

- The software also helps you manage your employees’ leave requests and time off requests, as well as their health insurance claims.

Cons

QuickBooks Payroll. Cons:

The major drawback of QuickBooks Payroll is that it is only available in the United States. However, if you are located outside the US and want to use this software, then you need to find a partner who can provide support for QuickBooks Payroll in other countries.

In addition, QuickBooks Payroll is not suitable for small businesses because it comes with a fair amount of complexity when it comes to managing payrolls. The user interface of this software also needs improvement as it looks outdated and takes time to understand how it works.

QuickBooks Payroll. Cons:

It’s pricey, with a price tag of $150 per month or $200 per year. If you’re just starting out, it might be worth waiting to get your feet wet with the free trials of other services that offer similar features.

So far, it’s unclear whether QuickBooks Payroll will have any advantages over its competitors that use third-party payroll providers like ADP and Paychex. The main benefit of using QuickBooks Payroll is that it’s integrated into QuickBooks Online — but so is everything else in QuickBooks Online! A lot of small businesses already use QuickBooks for accounting purposes, so this integration makes sense.

Cost

QuickBooks Payroll is a payroll solution for single-user, multiple-users and multiple companies. It’s also available in QuickBooks Online Payroll QuickBooks Payroll gives you the ability to track and manage your payroll in one place.

It keeps accurate records of employee information, payments, taxes and more. The cost depends on which version of QuickBooks you choose: QuickBooks Enterprise Solutions includes all the features of QuickBooks Professional Plus and adds advanced business management tools like Advanced Inventory Management and Point-of-Sale.

It costs $3,499 per month.

QuickBooks Premier Edition includes all the features of QuickBooks Pro Plus or Enterprise Solutions plus advanced business management tools like Advanced Inventory Management and Point-of-Sale. It costs $2,299 per month.

11. Xero

Xero is a cloud accounting software package for small businesses. Xero provides online accounting software for small businesses and self-employed people.

It is comparable to QuickBooks Online. The software allows users to view their finances, manage bank accounts and pay bills through mobile devices and web browsers. Xero’s features include: Accounting services – Users can import financial transactions from various banks, including Bank of America, Chase, Wells Fargo and others.

Xero offers invoicing tools to create professional-looking invoices, track sales tax payments and generate reports on customer payments.

Payroll – QuickBooks Online integrates with Intuit’s payroll service called Intuit Payroll Service (IPS). IPS customers can use the program to pay employees using direct deposit or paper checks sent through the U.S. Postal Service.

Other features include electronic filing of federal payroll taxes, including Form 941 (quarterly wage report), Form 940 (annual wage report) and Form W-2 (information returns).

Invoicing – Users can send invoices online or via email to clients in several formats including PDFs, Excel spreadsheets or even as Word documents that can be edited by recipients prior to payment being processed by Xero if needed.

Best For

The best all-around accounting software for small businesses, Xero has an intuitive design and a simple pricing structure that’s easy to understand.

The software offers a free, 30-day trial and comes with all of the basic features you need to start, including invoicing, bank reconciliation and invoice management. Plus, it integrates with over 1,000 online services and apps to help your business grow.

Xero offers three different plans: Starter ($19 per month), Plus ($29 per month) and Premium ($49 per month). Despite its simple design, Xero also offers robust features like inventory tracking, project management tools and time tracking features.

If you want more advanced features like multiple currencies or integrated payroll services, you’ll need to upgrade your plan or purchase them separately (for example, the Advanced Inventory Module costs $25 per month).

Key Features

Xero is a cloud accounting software that helps to manage, track and grow your business. It can be used by accountants, small businesses and freelancers. It’s designed for people who want to run their own business without having to spend hours on bookkeeping tasks.

With Xero, you get up-to-date insights into your business at the touch of a button.

Key Features

Invoice App Create professional invoices from your desktop or mobile device with Xero’s invoice app Payments Capture payments from anywhere with our secure payment gateway Bank Feeds Connect all your bank accounts and credit cards in seconds, then see all your transactions in one place Reporting & Insights Get real-time insights into how your business is performing so you know where to focus next

Pros

- It is easy to use and very intuitive.

- The software is cloud-based, so you can access your accounts from anywhere.

- You can see all of your financial information in one place, including assets and liabilities, income and expenses, bank accounts, credit cards and more.

- You can see how much money you have left over after spending, so it’s easier to track your cash flow and make sure that you don’t spend more than you have available at any time during the month or year (or ever).

- All of the information is stored securely online so if something happens to your computer or phone, there will still be a copy of all of this information somewhere else.

Cons

Xero is the most expensive accounting software on the list and the only one that requires a subscription. If you have a small business, this might not be worth it.

If you’re looking for an accounting solution that will grow with your business, however, Xero could be a great fit. The free version of Xero lacks some features that are available in other accounting software packages, like inventory management and payroll processing.

The full version is $30 per month for unlimited users and up to 40 transactions per month or $500 per year for unlimited transactions with no monthly fee. You can also pay $60 per month for unlimited users and up to 200 transactions per month or $1,000 per year for unlimited transactions with no monthly fee.

Xero offers some helpful integrations with other services such as Salesforce, Google Analytics and QuickBooks Online, which makes it easier for businesses to stay connected across multiple platforms without having to do all of the work on their own.

Cost

Xero is a cloud accounting software that’s easy to use, powerful, and affordable. It helps you stay on top of your business finances with features like invoicing, expense tracking, real-time reporting and more.

Xero comes in three versions: Xero Essentials is free for up to three users, but has limited functionality. Xero Plus costs $10 per user per month.

It includes everything in Essentials, plus inventory management and multi-currency support. Xero Premium is $20 per user per month.

It includes everything in Plus, plus payroll, purchase order management and more. Xero is the most popular accounting software for small businesses.

The company says it has more than 500,000 customers, which is a lot considering they charge $19 per month and $80 annually. Xero is easy to use and has many features that make it great for small business owners, including integrated payroll, customizable invoicing and expense tracking.

It also offers a mobile app that lets you manage your finances on the go.

12. Wave

Wave is the next generation of accounting software, built for small businesses. Wave offers features like invoicing, expense tracking, receipts and payments in one place, so you can focus on growing your business.

Wave makes accounting easy and affordable. Pay-as-you-go pricing means no upfront costs or long-term contracts.

Wave is trusted by over half a million small business owners across the globe because it’s fast to set up and simple to use.

The free plan includes invoicing, expense tracking, receipts and payments. Upgrade to one of our paid plans to unlock more features like recurring billing, project management, inventory management and more.

Wave is designed with simplicity in mind so you can spend less time accounting and more time growing your business.

Best For

Wave is a very simple app that lets you create and send GIFs. It offers a similar set of features as other GIF apps, but its interface is much simpler and easier to use.

You can create your own animated GIFs by recording your screen with your phone’s built-in camera or by capturing a photo or video from your camera roll.

The app also supports importing existing files (video and photos) from your phone or Dropbox account. Once imported, you can edit the file by cutting it into pieces, changing its speed and adding text or stickers to it.

Wave’s interface is very intuitive and easy to use. There are several different themes available for the app’s background color scheme, so you can choose something that matches your personal style.

I like how Wave lets users change colors on the fly without having to go back into the settings menu; simply tap on a color block in the top-right corner of the app’s home page and choose another color from the pop-up menu that appears next to it. This makes it easy for users who have trouble reading small text on dark backgrounds (like me).

Key Features

Wave is a powerful, yet easy to use, tool for creating and editing sounds. With Wave, you can record, edit and play back audio directly on your Android device.

Wave provides advanced features such as multi-track audio recording and mixing, real-time effects and support for multiple sound cards. Wave is designed to be simple enough for the average user yet powerful enough for professionals.

Wave Key Features:

- Create and edit audio files directly on your Android device

- Record live audio input or use existing audio files as source material for editing (e.g., record from a microphone or any other source such as streaming music players)

- Open multiple audio tracks in the same project file to create multi-track projects (limited by available memory)

- Apply real-time effects like reverb, compression or EQ to individual tracks or all tracks at once using a single fader control per track (multiple effects can be applied at once using multiple faders)

- Save your project files locally on your device’s storage or upload them to the cloud (Dropbox integration) where they can be accessed from any computer with an internet connection

Pros

- It’s free and open source, so it’s easy to use, but it still has all the functionality of a paid app

- You can use it online or offline.

- If you need access to your data while on an airplane or in the subway, you don’t have to worry about losing connection!

- It’s really easy to use.

- This is especially important for new users who might not be familiar with some of the features of other apps, like how to record audio or attach files. Wave has a simple design that makes everything straightforward and intuitive.

Cons

Wave is a platform that allows you to manage your email, tasks, and calendar from one place. It’s also a solution for teams who want to collaborate on projects.

There are two types of Wave accounts: personal and team. The difference between the two is that team members can access all data on their shared boards, while personal users can only see their own tasks and emails.

If you’re looking for something more advanced than Gmail, Wave could be a good choice. However, it has a few drawbacks too: It’s not free — The personal version costs $5/month while the team version costs $10/month (prices are subject to change).

It can’t replace every tool in your digital toolbelt — Although it does have some powerful features like task tracking and project management tools, it doesn’t offer everything you might need (for example, there isn’t an analytics tool).

If you don’t need anything beyond basic email management tools and maybe some light project management capabilities then Wave may be a good fit for you but if you’ve got specific needs then you may want to look elsewhere.

Cost

Wave is a new open standard for interoperable, blockchain-based digital identity. In June 2019, the Wave team launched its mainnet, which enables anyone to create a verified digital identity using Wave’s open API.

The process of creating a verified identity involves submitting documents that are then reviewed by independent third parties known as attestors. After confirming the authenticity of the submitted documents, an attestation signee issues an attestation statement that includes information about the identity being verified and its owner.

Once an attestation statement has been issued, it’s stored on the blockchain as part of a transaction that can be viewed by anyone and is immutable — meaning it cannot be changed or deleted — forever.

This record provides proof that the person identified in an attestation statement is who they say they are, which can be used to verify their identity in other contexts like opening bank accounts or applying for jobs online.

13. Zenefits

Zenefits is a software company that provides services to help businesses manage their employees’ health, payroll and insurance. Zenefits was founded in 2013 by David Sacks, who was previously the COO of PayPal, with the goal of making health insurance more affordable and accessible to small businesses.

In September 2015, Zenefits raised $500 million in Series C funding led by Technology Crossover Ventures, with participation from Andreessen Horowitz and other existing investors.

[5] In October 2016, Zenefits announced that it had surpassed $100 million in annualized recurring revenue. [6] In January 2017, Zenefits announced that it had raised an additional $500 million as part of a Series D round of funding led by Fidelity Management & Research Company (FMRC) and Dragoneer Investment Group.

[7] The company has raised a total of $583 million in venture capital financing as of April 2018.[8] In February 2017, Zenefits laid off 250 employees after failing an audit by the State of California due to improper licensing issues.

[9] In March 2017, the company announced it would lay off another 27% of its workforce due to poor sales performance.[10] On July 11th

Best For

Companies with a significant number of employees (over 50, ideally) and a need to manage health insurance benefits, this is the platform for you. Zenefits offers the most robust set of features for companies who want to manage their own insurance program.

Zenefits offers an intuitive dashboard for managing employee benefits, health plans, payroll and taxes. Zenefits also integrates with dozens of other business tools such as Slack and Salesforce so that you can easily track employee activity across multiple apps in one place.

Zenefits can make it easy for companies to manage their health benefits internally without having to hire an additional person or partner with a third-party vendor. It’s especially useful in the early stages of a company’s growth when you don’t have the resources to hire someone else or pay for outside help.

Key Features

Zenefits has become the go-to HR platform for small businesses. With a wide range of features, user-friendly interface and affordable pricing plans, Zenefits is a great tool to help you manage your employees easily.

Here are some key features that make Zenefits one of the best HR software:

Employee Self-Service – Employees can access their own information, including benefit premiums and claims status updates. This helps eliminate the need for repetitive paperwork and ensure that employees have timely access to their information.

Payroll – From calculating payroll taxes to managing tax deductions, Zenefits will keep track of everything for you so you don’t have to worry about compliance issues with IRS regulations. Benefits Administration – Employees can enroll in benefits programs directly from their profiles, as well as submit claims online through the app or website.

You can also access detailed reports on your benefits spendings and plan memberships at any time. Time & Attendance – Manage employee attendance easily with this feature that allows you to track when they clock in or out of work, plus automatically generate reports based on those times.

This feature also allows you to create schedules for each employee according to their availability over weekends or holidays as needed without leaving any gaps in coverage during

Pros

Zenefits is a free online HR platform that makes it easy for small and growing businesses to manage their benefits, payroll, and employee information. The software can be used in conjunction with a number of payroll services, including Gusto and ADP.

Zenefits also offers an employee referral program that rewards your employees for referring new hires who become active users within 30 days of signing up. You’ll also get a $1,000 credit toward your first month of payroll service.

Easy setup process

Free to use

No contracts or commitments

Integrates with Gusto and ADP

Cons

Zenefits is a cloud-based HR software that helps companies manage their employees’ insurance, and it’s been around since 2013. Its main competitor is Gusto, another HR tech startup that offers similar services.

But Zenefits has faced some serious problems in recent years. The company has struggled to scale up its business as quickly as it hoped, and it’s been hit with regulatory issues over the past few years.

Zenefits was founded by Parker Conrad, an ex-Y Combinator entrepreneur who previously sold another startup to Yammer for $1 million. After being acquired by Yammer, Conrad started Zenefits as a way to help small businesses manage their employee insurance plans.

The idea was that this would be a more efficient way of doing things than having employees call their insurance providers themselves or sending them paper documents via snail mail.

Zenefits initially charged businesses $89 per month for access to the platform, but later switched to a free model (with optional paid premium features) after realizing that people weren’t willing to spend money on HR software unless they were required to do so by their employers.

The company raised $4 million in venture capital from Khosla Ventures and others in 2013, followed by another $15 million round in

Cost

$20/month for up to 100 employees; $80/month for up to 500 employees; $150/month for up to 1,000 employees. Zenefits is a cloud-based software platform that helps small businesses manage their HR needs.

It offers payroll, benefits and human resources services in one place, and it’s designed to help small businesses save money and time. Zenefits also has a mobile app that lets you manage your company from anywhere.

Zenefits is free for up to three employees, and you can upgrade at any time if you need more features or more users. The cloud-based software comes with basic payroll and benefits management tools, but if you want more advanced features like time tracking, desktop scheduling or employee self-service portals, you have to pay extra for them.

The cost varies based on how many employees you have: $20 per month for up to 100 employees; $80 per month for up to 500 employees; $150 per month for up to 1,000 employees (prices are subject to change).

14. ADP Workforce Now

ADP Workforce Now is a cloud-based human resources management system that offers single sign-on access to all of your HR systems. ADP Workforce Now is an Enterprise Resource Planning (ERP) system that provides a 360-degree view of the employee lifecycle, including employee onboarding, payroll and benefits administration, time and attendance, and talent acquisition and development.

ADP Workforce Now also offers payroll integration with ADP’s other products through ADP Workforce Now Connectivity, which enables you to easily connect payroll data to other applications in your business.

ADP Workforce Now gives you access to powerful analytics that help you make informed decisions about hiring trends and workforce growth within your organization.

Best For

Small and medium-sized businesses that need a single payroll provider Cost: $0 to $1,000 per month (depending on the size of your business) ADP Workforce Now is designed for small and mid-sized businesses that need a single payroll provider.

The service offers everything you’d expect from any other payroll system, including electronic filing with the IRS, direct deposit and tax reporting. However, unlike other automated payroll solutions, ADP Workforce Now does not require you to purchase software or hardware upfront.

The company charges a flat monthly fee based on your company size — ranging from $0 to $1,000 per month — so there are no additional costs associated with using this service. The biggest benefit of using ADP Workforce Now is that it makes payroll management easy for small business owners and HR professionals who don’t have time or resources to manage their own payroll system.

Key Features

ADP Workforce Now. Key Features: ADP Workforce Now is a cloud-based solution that provides businesses with the tools to manage their global workforce. It offers easy access to real-time data and insights, allowing you to make better decisions about your people, processes and technology.

Key features include

Employee scheduling: Manage your employees’ schedules in real time by assigning shifts and approving requests for time off. Time & attendance: Monitor employees’ attendance across multiple locations to ensure compliance with local laws and regulations.

PTO tracking: Track employee PTO balances and accrual rates as well as days used or forfeited per employee. ayroll compliance: Ensure payroll complies with government regulations while eliminating double handling of payroll data by automatically generating accurate calculations of employee wages and taxes based on rules set by you.

Pros

ADP has the best customer support I have ever experienced. If a client has an issue with their payroll, they reach out to ADP and they make it right immediately.

The software is easy to use and very user friendly. My favorite thing about it is that it integrates with other programs like QuickBooks and Salesforce, but also does not require you to use these programs in order for it to work well for you!

Cons:

I do not like that even though you can integrate with QuickBooks or Salesforce, there are fees associated with those integrations on top of the software costs. However, once those fees are paid (usually only once), they are usually covered by the vendor so you don’t need to worry about paying any additional fees beyond one-time setup costs.

Cons

ADP Workforce Now is a web-based payroll solution that allows you to run your business from anywhere at anytime. t has a variety of features to help you manage your employees, and it can also be integrated with other software to help streamline your business processes.

It’s less robust than some of the other payroll solutions we reviewed, so if you need more complex tools for HR and payroll management, check out Gusto instead.

– The app is not available for all devices.

– There are no refunds.

– The app is not optimized for tablets.

– It does not support Android Wear, which means you cannot use it on your smartwatch.

– You cannot download a copy of your resume for reference offline, which is useful when you are traveling or do not have Internet connection.

Cost

ADP Workforce Now. Cost:

$7 per employee, per month. (For a company with 500 employees, that’s $3,000 a month.)

ADP Workforce Now. is the company’s web-based HR software that includes payroll, benefits, time and attendance, and other HR functions. The cost varies based on your company size and needs.

The more you use ADP for payroll, the less it costs you. If you want to use ADP for only payroll and nothing else, the cost is $7 per employee per month — or $3,000 for 500 employees — with no other charges.

If you also want to use ADP for benefits enrollment and administration, sick leave accrual and management, vacation tracking and time off requests, etc., the cost goes up by $2 per employee per month (or $1,200 for 500 employees).

15. Justworks